Editor’s Note: This perspective was originally published on Health Affairs Forefront on February 16, 2024.

By specifying upper limits on what manufacturers can charge Medicare for selected drugs, the Inflation Reduction Act (IRA) delegates broad discretion to the Secretary of Health and Human Services (HHS) to set prices after assessing each drug’s value. For HHS to evaluate whether the drug prices it sets for Medicare are fair and reasonable, it would be helpful to know the true prices that all other payers (both public and private) pay for the same drugs. However, complexity and lack of transparency in drug pricing obscure the answer to this seemingly straightforward question Rebates—confidential payments—generate the difference between publicly known nominal prices and actual net prices, where net prices equal the amount paid to a manufacturer after deducting all price concessions made to health plans, their pharmacy benefits managers, or any other entities. HHS has access to confidential information about net, after-rebate prices available to many public payers but not to commercial payers. Requiring that manufacturers disclose to HHS, on a confidential basis, their commercial rebates for each costly drug selected for “negotiation” under the IRA would provide clarity about actual prices, facilitate the assessment of value, and inform the setting of appropriate prices.

A key goal of the IRA is to lower Medicare prices for expensive drugs. The IRA targets expensive products that that do not face competition from a generic or biosimilar and have had at least seven years of market exclusivity for small molecule drugs or 11 years for biologics. For the ten drugs selected for negotiation during 2024, nominal US prices ranged from three to eight times the prices in other developed countries. However, estimates suggest that rebates constitute an estimated 49 or 50 percent of the US prices for six of the drugs. Having HHS set the “maximum fair price” (MFP) for Medicare without knowing the actual, post-rebate (net) prices received by a manufacturer from all payers – including Medicaid, the 340B program and commercial payers — creates uncertainty about the magnitude of the actual price cut and complicates understanding the value of a drug relative to therapeutic alternatives.

Background on IRA Maximum Fair Price

The IRA directs HHS to identify annually a limited number of costly medications and set their MFPs for Medicare. Although termed a negotiation, the IRA effectively empowers the Secretary to unilaterally set the MFP, taking into account a variety of factors including the value of the medication and the availability of therapeutic alternatives.

The IRA specifies that the upper limit on the MFP for a selected drug is based on the lower of two different measures. One measure would initially set the MFP ceiling at 40 percent of the “non-Federal average manufacturers price” (non-FAMP) for any drug with at least 16 years of market exclusivity, but at 75 percent of non-FAMP for any other selected drug. Non-FAMP is a confidential price reported to the Veterans Administration by manufacturers and reflects the average price wholesalers pay manufacturers for a brand drug distributed to nonfederal purchasers. Importantly, non-FAMP does not reflect the rebates a manufacturer pays to health plans and pharmacy benefit managers.

The alternative measure for determining the MFP ceiling is 100% of the average net Medicare Part D price. The net Medicare price reflects the enrollment-weighted average price for all national drug codes (NDCs) of a selected drug for all Part D plans. (The manufacturers of the 10 selected drugs have 269 different NDCs, reflecting different dosages, routes of administration and/or package sizes.) The net Medicare Part D price includes rebates, non-public information that plans report to CMS as “direct and indirect renumeration.”

Variation in Rebates and Prices: Part D, non-FAMP, Medicaid, and the Federal Supply Schedule

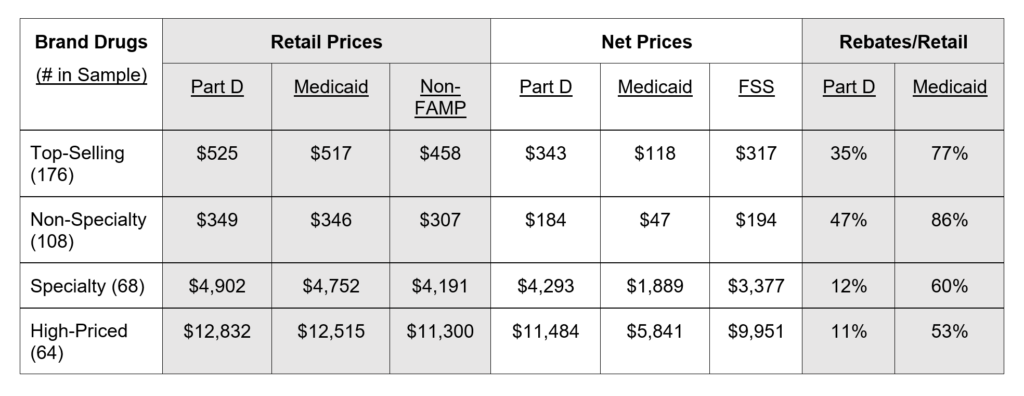

A comparison of publicly available retail prices and non-public actual prices net of rebates illustrates great variation across payers, highlighting the challenge faced by HHS in determining an appropriate price for Medicare. Using its access to confidential data, the Congressional Budget Office (CBO) reported average retail and net prices in 2017 for Part D and Medicaid, as well as non-FAMP and the Federal Supply Schedule (see below).

CBO analyzed a total of 210 brand drugs, of which 176 were top-selling and 64 were high-priced, with 30 drugs falling into both categories. They reported results for high-priced drugs and, for top-selling drugs: the total, the subset that were specialty drugs, and the remaining non-specialty drugs. As summarized in Exhibit 1, retail prices were virtually the same in Part D and Medicaid but net prices differed markedly because rebates and discounts in Part D averaged less than half of those in Medicaid. For both top-selling specialty drugs and high-priced drugs, Part D net and non-FAMP prices aligned closely (within 2.5 percent, despite non-FAMP excluding rebates); both were dramatically higher than Medicaid net prices.

Source: authors’ summary of data from Congressional Budget Office.

Notes: Non-FAMP is non-federal average manufacturers price. FSS is Federal Supply Schedule

Significant variation in the Part D or commercial net price of a drug occurs because plans with large enrollment and tight formularies can negotiate larger rebates from a manufacturer than plans with fewer enrollees and less restrictive formularies. Unlike market-driven variation in the net prices for a drug, government regulations result in uniform Medicaid or 340B net prices for a drug that are substantially below the average commercial or Part D net prices negotiated by a manufacturer. Similarly, Federal Supply Schedule rules require brand manufacturers to charge VA (on behalf of all direct federal drug purchasers) the lowest net prices negotiated with their most-favored commercial customer, resulting in prices well-below average commercial net prices and also below Part D net prices (Exhibit 1).

Do Upper Limits on MFPs Substantially Exceed Actual Net Prices?

The key decision for the Secretary entails where to set the MFP, for which the IRA specifies the ceiling but not the floor. To illustrate the uncertainty about where to set the MFP relative to the ceiling price, consider two drugs with very different estimated rebates: Imbruvica® with rebates estimated at 9 percent of its retail price and Eliquis® with rebates estimated at 49 percent. If rebates for Imbruvica are modest for all payers, 75 percent of non-FAMP is likely to be lower than both the actual average net price for payers and a ceiling price based on Part D. In contrast, an Eliquis® ceiling price based on 75 percent of non-FAMP is likely to exceed the actual average net amount that the manufacturer receives because its substantial rebates are excluded from non-FAMP. Similarly, if the relationships for retail, net Part D, net Medicaid and non-FAMP prices for Eliquis® are broadly similar to those reported by CBO (Exhibit 1), an Eliquis® ceiling price based on the Part D average net price is also likely to exceed either the actual average net price the manufacturer receives from all payers (including Medicaid and 340B) or the net price from the most favored commercial customer. Under the current process for establishing the MFP, the manufacturer but not the Secretary will have detailed information on rebates and net prices.

It would appear inconsistent with a key policy goal of proponents of the IRA if the MFP limiting what manufacturers may charge Medicare were set above the actual average net price from most-favored commercial customers and, for those advocating sharply lower drug costs, the actual average price from all payers. Alternatively, setting MFPs substantially below actual net prices might have a chilling effect on investment and limit the development of new drugs. Without knowing actual net prices, variations in ceiling prices relative to net prices increase the risk of setting MFPs that are too high in some cases and too low in others.

Value of Information on Actual Net Prices

Another challenge for the Secretary is establishing the value of a drug, especially when different dosages are intended for patients with different diseases or characteristics, so the value of the drug might vary in relation to alternative therapies. For products with multiple NDCs used to treat patients with different indications and characteristics, knowing the net price for each NDC would provide insight into how the manufacturers assess the value relative to therapeutic alternatives. As an example, Enbrel® has 31 NDCs that differ in dosage, package size, and/or route of administration to treat multiple inflammatory conditions in adults as well as children. Analyzing the net prices by NDC would inform HHS about the variation in actual average prices a manufacturer accepts on a per package, per dose and per unit basis.

Manufacturers have a strong self-interest in maximizing net revenues from their products and presumably invest heavily in understanding the market for each product and its competing therapeutic alternatives. The distribution of average net prices for differing NDCs represents a manufacturer’s informed judgment about the value of each NDC relative to competing therapeutic alternatives. The resulting “price discrimination”—which economists typically view as an important mechanism for maximizing revenue, especially for products for which variable (production) costs are small in relation to development costs—suggests a manufacturer is unlikely to maintain the same net price per unit when differing therapeutic alternatives exist for a product. As a result, analyzing variation in net prices by NDCs could inform HSS about the value of a manufacturer’s product relative to alternatives.

HHS will establish the per unit MFP for a drug after combining data from its NDCs, and the 10 drugs selected for negotiation have an average of 27 NDCs. By providing insights about value relative to therapeutic alternatives, more granular data about actual net prices can help inform negotiations on whether—and how much—below the ceiling price the Secretary should set the MFP. Depending on where the Secretary sets the MFP and how it is enforced over time, a manufacturer might selectively withdraw NDCs from the market (especially if the net prices of some are above and others are below the MFP) to drive volume to maximize permissible revenue, which could adversely affect patients.

Risks and Benefits of Requiring Data on Actual Net Prices

Requiring manufacturers to share information with HHS on actual net prices at the NDC level would lessen the information asymmetry between a manufacturer and HHS. The IRA provides for the confidentiality of manufacturer data, and HHS for many years has maintained the confidentiality of data on rebates and net price information in Part D and Medicaid. The added data would inform the Secretary, who has the authority to set an MFP below the ceiling price, after considering other factors for a drug such as its research and development costs, costs of production and distribution, prior federal financial support, value, and therapeutic alternatives.

From the perspective of a manufacturer, the answer to the question of whether divulging additional data on actual net costs would tend to make the Secretary opt for a lower or higher MFP might shift based on the policy preferences of an Administration. From our perspective, policy decisions benefit from having more rather than less information, so requiring data on actual net costs will improve MFP negotiations. Having appropriate data will enhance the likelihood of a Secretary making analytically sound decisions rather than reacting without adequate information to popular pressures to lower drug prices for Medicare beneficiaries or lobbying by manufacturers for a higher MFP.

Copyright © [2024] Health Affairs by Project HOPE – The People-to-People Health Foundation, Inc.

Lieberman, S. M., & Ginsburg, P. B. (2024). Knowing Actual Prices Will Help HHS Set The Maximum Fair Price Under The Inflation Reduction Act. Health Affairs Forefront.

Sign up for Schaeffer Center news

You must be logged in to post a comment.