Editor’s Note: This analysis is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between Economic Studies at Brookings and the University of Southern California Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national healthcare debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings.

State governments are incurring large costs to respond to COVID-19. And in the coming months, states will experience large declines in tax revenues and increased enrollment in safety-net programs as disruptions caused by COVID-19 drive incomes and consumption lower. Without assistance from the federal government, states will likely be forced to make deep program cuts, enact substantial tax increases, or both. Either strategy would worsen the economic downturn and its aftermath by compounding household income losses, and program cuts would also deprive state residents of valuable public services.

In recent weeks, Congress has sought to ameliorate the fiscal pressures on state governments by offering federal aid. While that fiscal relief will likely go a long way in offsetting the direct costs states are incurring in responding to COVID-19, it appears likely to fall short of what is needed to offset the broader fiscal pressures states will face from declining revenues and increased demands on safety-net programs.

Based on the historical relationship between unemployment and states’ fiscal position, we estimate that a one percentage point increase in the unemployment rate corresponds with around a $45 billion deterioration in state budgets. Under relatively optimistic assumptions about the flexibility of the enacted state fiscal relief, this estimate implies that the enacted funds will be enough to offset the fiscal pressure associated with an increase in the unemployment rate that averages 3.3 percentage points over the next 12 months; under less optimistic assumptions, that figure would be 1.1 percentage points. In later years, the enacted fiscal relief will be enough to offset an increase in the unemployment rate of just 0.9 percentage points—and only as long as the federally declared public health emergency remains in effect. Unfortunately, it is likely that the unemployment rate will rise more than this (perhaps far more than this) in the near term and then remain elevated for an extended period.

For this reason, Congress should consider offering states additional relief tailored to the depth and duration of the coming economic downturn. Draft COVID-19 response legislation put forward by House Democrats last week would have increased each state’s federal matching rate under Medicaid in proportion to the amount that the state’s unemployment rate exceeded a threshold level. The increases in the federal matching rate under the House proposal would offset slightly more than two-thirds of the fiscal pressure associated with increases in the unemployment rate above the threshold. This approach, which is similar to one we put forward in joint work with Jason Furman last year, would ensure that fiscal relief was appropriately tailored to actual economic conditions by delivering substantial fiscal relief as long as the economy remained weak and then phasing that relief down smoothly as the economy recovered.

The remainder of this analysis examines these issues in greater detail. We first briefly review the nature and magnitude of the fiscal pressures on state governments and the consequences of state efforts to close their budget holes. We then assess the adequacy of the fiscal relief Congress has enacted to date and briefly discuss the House proposal to tie state fiscal relief to future economic conditions.

Coming Fiscal Pressures on State Governments

COVID-19 has placed two kinds of fiscal pressures on state governments. First, states are directly responsible for large portions of the public health response to COVID-19, including formulating and enforcing social distancing policies, performing disease surveillance and contact tracing, and troubleshooting health care system capacity and supply issues. States may also face increased costs in Medicaid and state employee health plans as enrollees seek COVID-19 testing and treatment, although these costs may be offset in whole or in part by lower utilization of deferrable services. We are unaware of any comprehensive estimates of these direct costs, but they could be substantial.

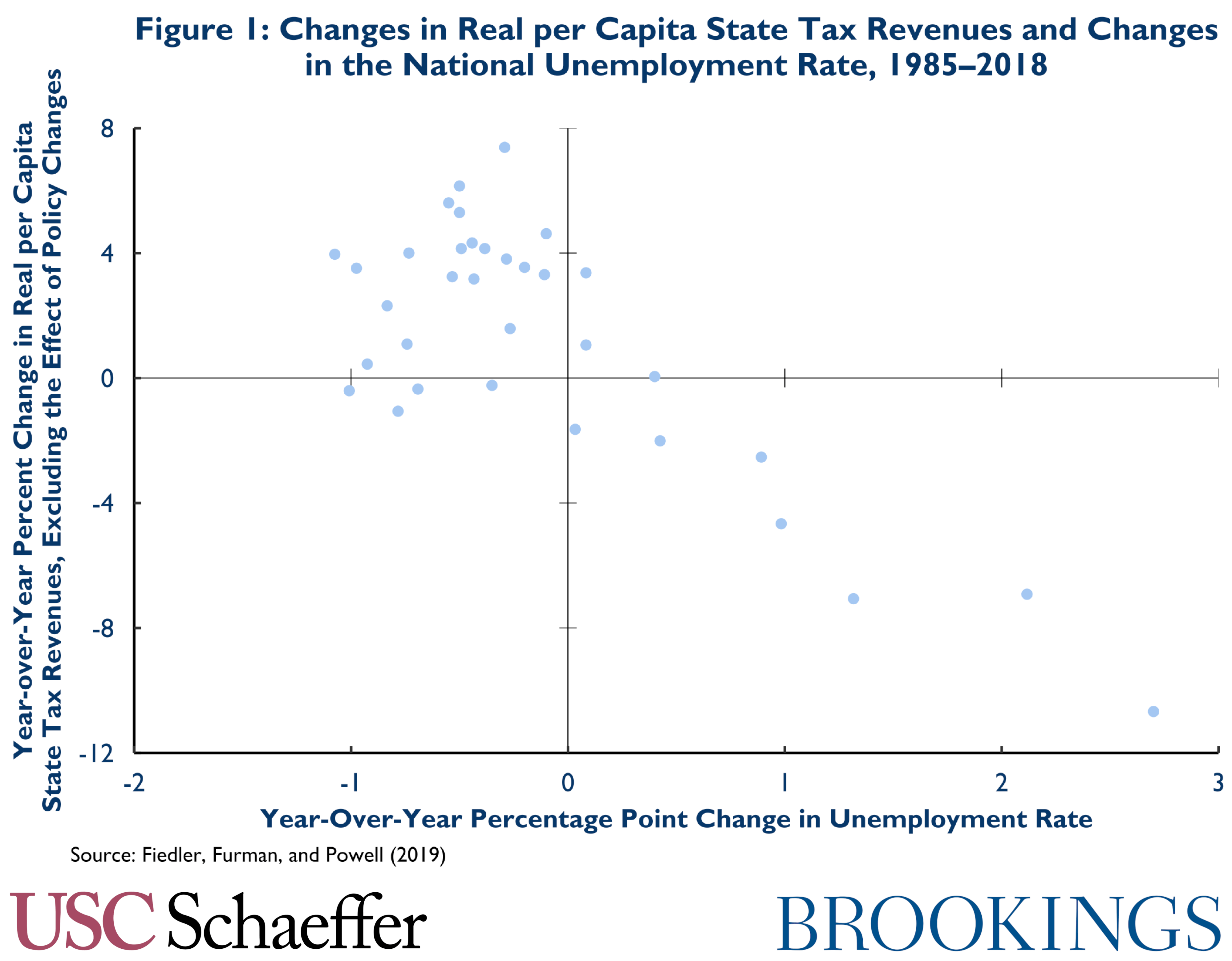

Second, the (necessary) reduction in economic activity spurred by actions taken to slow the spread of COVID-19 will also affect state budgets by reducing revenues from sales, income, and other taxes. Figure 1 illustrates that increases in unemployment have historically been associated with large declines in state tax revenues. Indeed, in our prior work with Jason Furman, we used these data to estimate that a one percentage point increase in the national unemployment rate has historically been associated with a 3.7 percent reduction in state tax revenues, holding state tax policies constant.

State governments collected $1.1 trillion in calendar year 2019, so this historical relationship implies that a one percentage point increase in the unemployment rate would coincide with a $41 billion reduction in annual tax revenues. Accounting for pressure on the spending side of state budgets from increased enrollment in Medicaid and other programs, the total amount of fiscal pressure on state governments associated with a one percentage point increase in the unemployment rate is likely closer to $45 billion.[1]

Of course, the relationship between the unemployment rate and state fiscal conditions could differ to some degree in this downturn, particularly while social distancing restrictions remain in effect, pushing this estimate higher or lower. For example, some forecasters have suggested that social distancing restrictions will keep some people who lose their jobs from looking for new ones, causing them not to be counted as unemployed in official statistics. In that case, the increase in unemployment could understate the true deterioration in economic conditions. The fact that many retail businesses are closed could also cause sales tax revenue to fall more than in prior downturns.

On the other hand, some have suggested that layoffs in this downturn may be more skewed toward low-earners and that reductions in hours for workers who remain employed may be smaller in relation to the increase in unemployment, both of which would cause any given increase in the unemployment rate to drive a smaller reduction in state tax revenues. The recently enacted unemployment insurance expansions, which are broader than those enacted in past downturns, could also cause increases in unemployment to have a modestly smaller effect on state tax revenues (as long as the expanded benefits remain in effect) since those benefits are generally taxable by states. In any case, while additional work investigating the likely dynamics of state tax revenues in this downturn would be worthwhile, we believe that the historical relationship between unemployment and tax revenues is a reasonable starting point.

Even if COVID-19-related social distancing restrictions can be relaxed relatively quickly, the economy is unlikely to return immediately to full employment. Despite the steps Congress has taken to cushion the economic blow, the temporary reduction in economic activity is likely to cause some longer-lasting economic harm, including by damaging household and business balance sheets, forcing firms to cease operations, or persistently depressing consumer confidence. If this type of economic scarring does occur, then the fiscal pressures on state governments are likely to persist for an extended period as well.

Rationale for State Fiscal Relief

State governments are generally required to balance their budgets. The stringency of those requirements varies from state to state, and states have some ability to circumvent those requirements, at least for a time, such as by drawing down “rainy day funds.” But in the face of large and persistent budget shortfalls, states will generally be required to either cut spending or raise revenues. Those types of responses by state governments would do harm in three ways.

First, spending cuts—the main tool states have used to close budget shortfalls in recent economic downturns—directly deprive residents of the benefits of state services. There is little reason to believe that the value of these services, such as education, transportation, and public safety, falls during economic downturns. Thus, unless states were systematically overspending previously and cuts are targeted surgically on low-value spending, these cuts are likely undesirable. Cuts during this time could be particularly harmful to the extent that they fall on public health activities.

Second, any fiscal adjustments that states do make—whether to the revenue or spending sides of their budgets—are likely to reduce overall economic activity. State spending cuts translate into income losses for state employees and suppliers, while tax increases reduce the after-tax income of state residents. Those income losses are likely to cause follow-on reductions in economic activity, both by directly and contemporaneously reducing aggregate demand for goods and services and by increasing the risk that current disruptions cause scarring that weighs on economic activity for a longer period.

Third, closing major budget shortfalls is generally politically challenging and thus likely to consume a considerable amount of state officials’ time and attention. At the moment, that time and attention is likely much better used coordinating state governments’ public health responses to COVID-19.

Is the Enacted State Fiscal Relief Adequate?

The federal government can reduce the need for states to implement contractionary policy changes by providing aid to state governments. Recent federal legislation has provided some fiscal relief, which we review in the remainder of this section. In brief, enacted state fiscal relief is likely adequate to offset much or all of the direct costs states (and localities) will incur in responding to COVID-19, but will very likely fall short of offsetting the broader fiscal pressures states will face due to lower revenues and increased demand on safety net programs.

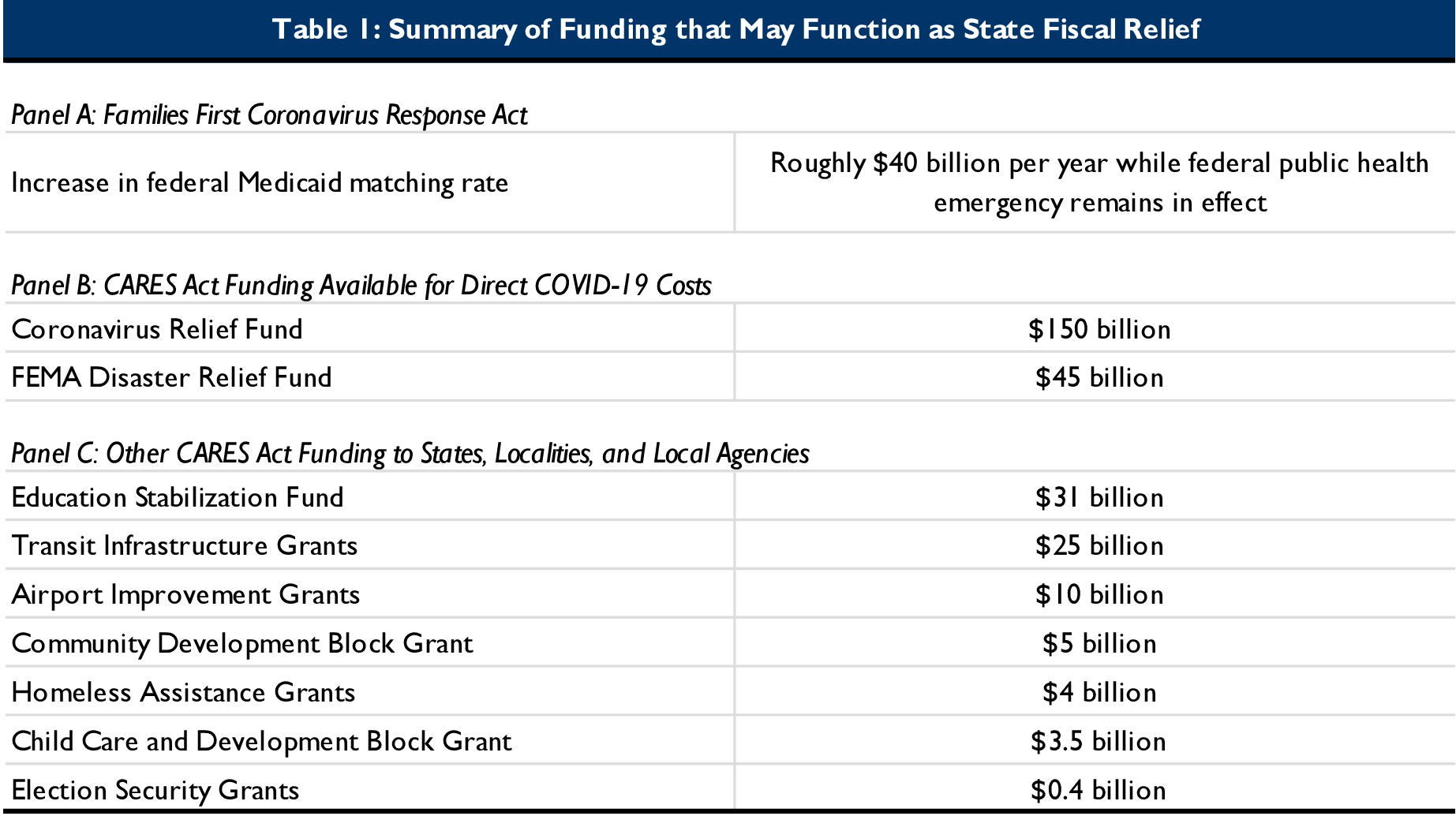

The Families First Coronavirus Response Act, enacted March 18, increased the share of Medicaid spending covered by the federal government (the “federal Medicaid matching rate”) by 6.2 percentage points in all states as long as a federally declared public health emergency remains in effect.[2] That provision will offer state governments around $40 billion on an annual basis while it is in effect. While these funds are delivered through Medicaid, they will help relieve states’ broader fiscal pressures by allowing states to redirect funds that they would otherwise have spent on Medicaid, if they wish to do so.

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), enacted March 27, will provide additional funding that will help reduce fiscal pressures on state governments. The funding summarized in Panel B of Table 1 will help offset a wide variety of direct COVID-19 costs state governments will incur but may do less to address the broader fiscal pressures states face.

Notably, the law appropriates $150 billion for a Coronavirus Relief Fund that states and localities can use to cover COVID-19 related costs. However, it bars recipients from using those funds for activities that were accounted for in previously enacted budgets. Precisely how the Treasury Department will implement this requirement is as yet unclear, but it will likely limit states’ ability to use these funds to cover costs that they would have incurred in the absence of COVID-19, thereby limiting the extent to which these funds will offset the broader fiscal pressures states are facing. The law also provides $45 billion for the Federal Emergency Management Agency’s Disaster Relief Fund, which can reimburse states and localities for COVID-19 response costs associated with a federally declared emergency under the Stafford Act. These funds are unlikely to be available to offset broader fiscal pressures.

The CARES Act also includes several other streams of funding for states and localities, which are summarized in Panel C of Table 1. In general, these funds are nominally provided to cover COVID-19 related costs in specific program areas. The list of allowable uses of these funds is sufficiently broad that at least a portion of the funds may be available to fund activities that would have occurred even in the absence of COVID-19, thereby freeing up funds that states can use to address broader fiscal pressures, but there may be some barriers to doing that in practice.

Notably, most of the funding in Panel C would accrue directly to entities other than state governments (such as local school districts, colleges and universities, or transit agencies), so states would need to somehow capture these funds (such as by cutting state aid to these entities). That will not always be possible, particularly in cases where these other entities are facing COVID-19-related budget pressures of their own. For example, transit authorities and airports may need all their allotted funding just to weather lower passenger volumes due to COVID-19. The Education Stabilization Fund also includes a maintenance of effort provision that bars states from reducing their own spending in this area below the level over the prior three years. The administration can waive that requirement, but whether it will do so is uncertain.

In sum, it appears plausible that the funding Congress has provided to date will be enough to offset much or all of the direct costs states will incur in responding to COVID-19, at least in the near term. But it appears unlikely that the enacted aid is enough to fully offset the broader fiscal pressures states will soon face.

If the additional Medicaid funding included in the Families First Coronavirus Response Act and one-quarter of the non-transportation funding in Panel C of Table 1 are ultimately available to offset broader fiscal pressures, then states will have $51 billion in federal funding available to offset broader fiscal pressures, plus $40 billion more for each subsequent year that the federal public health emergency remains in effect. If, consistent with historical experience, a one percentage point increase in the unemployment rate places $45 billion in fiscal pressure on state governments, then the enacted federal aid would allow state budgets to weather an increase in the unemployment rate that averages 1.1 percentage points over the next year. Thereafter, the enacted federal aid would be enough to weather an increase in the unemployment rate of only 0.9 percentage points—and only as long as the public health emergency remains in effect.

In a more optimistic scenario in which states can use three-quarters of the non-transportation funding described in Panel C of Table 1 and one-half of the Coronavirus Relief Fund to offset broader fiscal pressures, states will have $148 billion in federal aid available for these purposes, plus an additional $40 billion for each subsequent year that the federal public health emergency remains in effect. This would allow states to weather an increase in the unemployment rate that averages 3.3 percentage points over the next year and, if the public health emergency remains in effect, 0.9 percentage points thereafter.

Unfortunately, prominent forecasts suggest that employment is likely to fall much more sharply in the near term—and that it could remain depressed for some time. For example, forecasters at Goldman Sachs have predicted that the unemployment rate will increase by more than 11 percentage points in the near term and remain meaningfully above current levels into 2022. Even accounting for states’ ability to draw down rainy day fund balances, which might allow them to weather an additional 1.7 percentage point increase in the average unemployment rate for a one-year period, it appears quite likely that federal aid enacted to date will fall short of what is needed to prevent state governments from implementing tax increases or program cuts over the coming year and subsequent years.[3]

Federal Policymakers Should Provide Additional State Fiscal Relief Tied to Economic Conditions

There is thus a strong rationale for providing additional fiscal relief to state governments, at least if the coming economic downturn turns out to be as deep and prolonged as now seems likely. While federal policymakers could monitor economic conditions and provide additional relief on a one-off basis as appropriate, it is unlikely that this approach would deliver adequate relief in a timely fashion. A better approach would be to enact legislation now that would automatically tailor the amount of state fiscal relief to the depth and duration of the economic downturn.

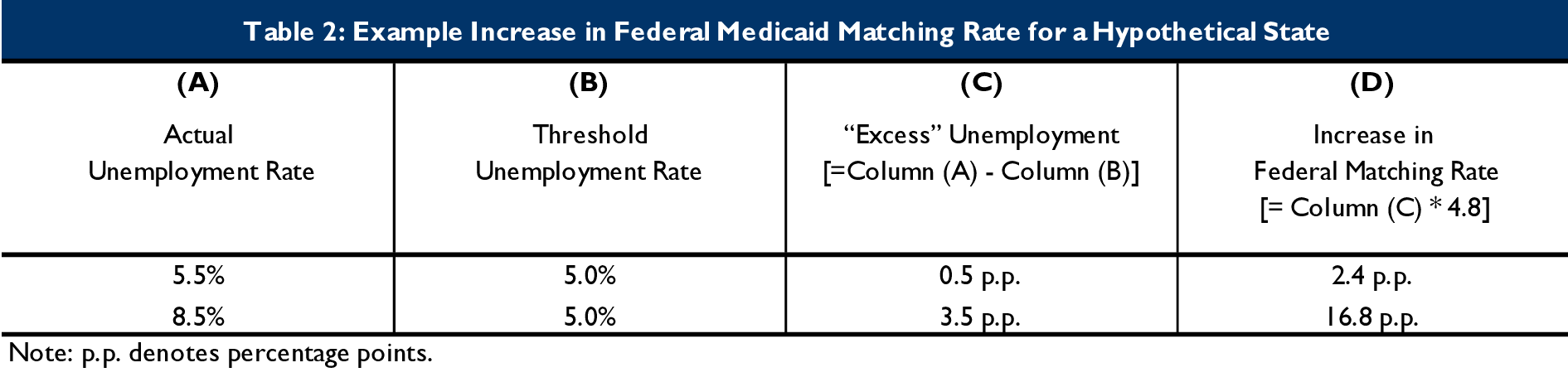

Draft legislation recently put forward by House Democrats would take this type of approach. Under the House proposal, a state’s federal Medicaid matching rate for a quarter would increase by 4.8 percentage points for each percentage point that the state’s unemployment rate exceeded a state-specific threshold. The state-specific threshold would be set at the lower of: (a) the state’s 20th percentile unemployment rate over the prior 60 quarters (15 years), plus one percentage point; and (b) the state’s mean unemployment rate over the prior 12 quarters (3 years), plus one percentage point. The increase under this proposal would be in addition to the enacted 6.2 percentage point increase in the federal matching rate tied to the public health emergency and would continue as long as economic conditions warranted (which may extend beyond the end of the declared public health emergency).

Under the proposal, a state’s federal Medicaid matching rate could rise no higher than 95 percent, but it could apply any increase in its matching rate above this limit to a quarter before the start of the current economic downturn; this approach ensures that states receive the full amount of intended assistance, while preserving some incentive for states to operate their Medicaid programs efficiently. To benefit from an increase in its matching rate under the proposal, a state could not change its eligibility rules or enrollment processes to be more restrictive than they were before the start of the downturn.

To provide a sense of the magnitude of the state fiscal relief the proposal would deliver, a nationwide increase in the federal Medicaid matching rate of 4.8 percentage points would deliver about $32 billion in additional Medicaid funds to state governments.[4] Since, as noted previously, a one percentage point increase in the unemployment rate is associated with a roughly $45 billion increase in fiscal pressure on state governments, it follows that the House proposal would offset slightly more than two-thirds of the fiscal pressure on states associated with unemployment in excess of the threshold.

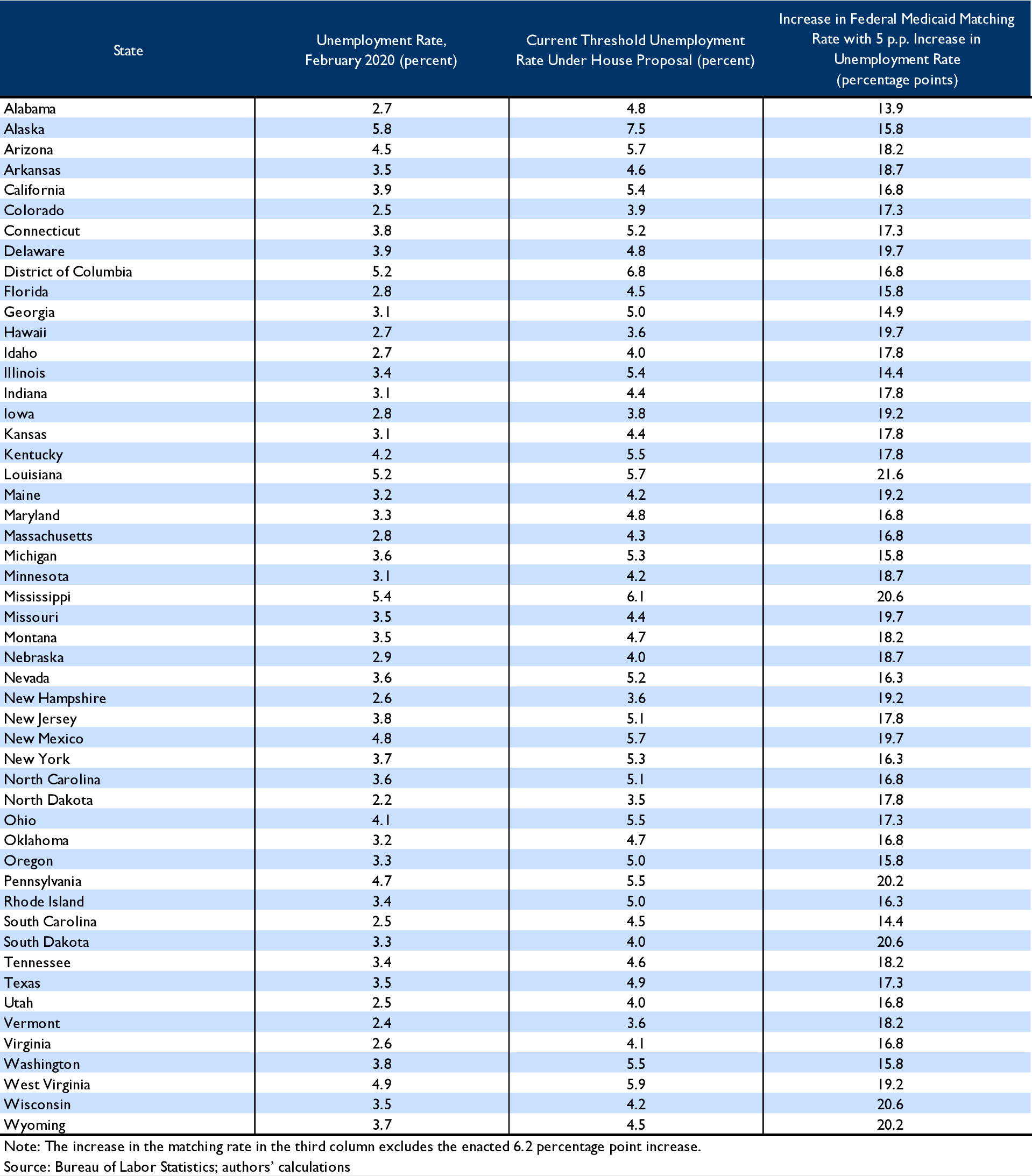

An example may help illustrate how the proposal would work in practice. Consider a hypothetical state with a threshold unemployment rate of 5.0 percent under the proposal. If the state’s unemployment rate was 5.5 percent, then the proposal would increase the hypothetical state’s federal matching rate by 2.4 percentage points (=[5.5% – 5.0%] x 4.8). By contrast, if the state’s unemployment rate was 8.5 percent, then the hypothetical state’s federal matching rate would instead rise by 16.8 percentage points (=[8.5% – 5.0%] x 4.8). For reference, the Appendix reports the current threshold unemployment rate for every state, as well as the increase in its matching rate if its unemployment rate rose by 5 percentage points.

As this example makes clear, the amount of fiscal relief each state received would be tailored to its economic circumstances. If a state experienced only a modest downturn, then the state’s federal matching rate would increase only slightly, consistent with the limited need for fiscal relief beyond what has already been enacted. But if a state experienced a larger downturn, its matching rate would increase by commensurately more. Importantly, the increase in the state’s federal matching rate would continue for as long as its economy remained weak and then phase down smoothly as its economy recovered.

This House proposal largely mirrors a proposal we put forward in joint work with Jason Furman last year, although there are some small differences.[5] That paper provides a lengthy discussion of the rationale for this general approach to providing state fiscal relief and, specifically, the rationale for using a threshold like the one in the House proposal to determine a state’s eligibility for fiscal relief. In brief, under the House proposal, a state’s threshold will generally equal the state’s 20th percentile unemployment rate over the prior 15 years, plus one percentage point.[6] In practice, the state’s 20th percentile unemployment rate over a 15-year period offers a crude, but readily operationalizable estimate of the unemployment rate that corresponds to full employment (since, in practice, the economy appears to spend relatively little time substantially above full employment). Adding one percentage point to this amount thus ensures that fiscal relief will flow if (and only if) a state’s economy is meaningfully below full employment.

Potential Variations on the House Approach

The House proposal is, of course, not the only way to deliver state fiscal relief that would respond automatically to changes in economic conditions. If they wished, policymakers could consider implementing a single national increase in the matching rate based on the national unemployment rate, rather than calculating different increases for each state based on its own unemployment rate. Basing fiscal relief solely on national economic conditions would make the proposal modestly simpler, but would worsen the proposal’s ability to target assistance to the states experiencing the greatest fiscal pressure.

Policymakers could also choose to deliver fiscal relief outside of Medicaid. For example, they could adopt the same trigger structure in the House bill but provide states with a transfer of about $90 per state resident for each percentage point that the unemployment rate exceeded the state’s threshold level. In the aggregate, this approach would provide about the same amount of fiscal relief as the House proposal. This approach would, however, require setting up a new programmatic infrastructure. Providing relief outside of Medicaid also gives states weaker incentives to avoid cuts to Medicaid, and protecting state Medicaid programs may be particularly desirable in the context of the current public health crisis.

Conclusion

In the coming months, state governments are likely to face serious fiscal pressures that will force them to take actions that will deepen the economic downturn and deprive their residents of valuable state services. The fiscal relief that Congress has offered states to date, while helpful, likely falls short of what is needed to offset the coming fiscal pressures on state governments. To avoid this outcome, federal policymakers could offer states additional federal aid that is tailored to the degree of economic distress in each state. Policymakers would do well to consider this approach.

Appendix Table: State-By-State Estimates

The table reports each state’s current unemployment rate, its current threshold unemployment rate under the House proposal, and the amount its Medicaid matching rate would increase under the House proposal in an illustrative scenario in which the state’s unemployment rate rose by 5 percentage points.

The authors did not receive financial support from any firm or person for this article or from any firm or person with a financial or political interest in this article. They are currently not an officer, director, or board member of any organization with an interest in this article.

We thank Kathleen Hannick for excellent research assistance, and we thank Loren Adler, Aviva Aron-Dine, Paul Ginsburg, Tracy Gordon, Michael Leachman, Christen Linke Young, and Louise Sheiner for helpful comments.

[1] In particular, our earlier work with Furman suggested that accounting for increased Medicaid enrollment would increase total pressure on state governments by around 7 percent: $41 billion x 1.07 is about $44 billion. There is likely some degree of additional fiscal pressure in other program areas, so we round up to $45 billion.

[2] This increase would apply with respect to most categories of Medicaid enrollees, but not enrollees covered by the Affordable Care Act’s Medicaid expansion.

[3] The National Association of State Budget Officers estimates that states (other than Georgia) had $72 billion in “rainy day funds” as of the end of their 2019 fiscal years, and Georgia budget documents indicate a balance of about $3 billion. Dividing this $75 billion total by the $45 billion estimate of the fiscal pressure on state governments associated with a one percentage point increase in the unemployment rate yields the 1.7 percentage point estimate cited in the text.

[4] The most recent Medicaid Actuarial Report projected that total state and federal spending on Medicaid benefits (excluding spending on Disproportionate Share Hospital Payments, which would not be affected under the proposal) would be $658 billion in federal fiscal year 2020. A 4.8 percentage point increase in the federal matching rate for that spending would increase federal payments to states by $32 billion per year.

[5] Specifically, our proposal would have based the threshold on a state’s 25th percentile unemployment rate over the preceding 15 years, rather than the 20th percentile. In practice, this difference matters little, but the 20th percentile may currently provide a slightly better estimate of the unemployment rate that corresponds to full employment than the 25th percentile. Our proposal also had a few other differences. Notably, it did not include the alternative threshold based on a state’s average unemployment rate over the prior 3 years; would have provided a large increase in the matching rate for states that have adopted the ACA’s Medicaid expansion, rather than applying the higher matching rate under the proposal directly to the expansion population; and would have applied the increase in the matching rate under this proposal to the Children’s Health Insurance Program and to Medicaid administrative expenses in addition to Medicaid benefit spending.

[6] Early in a downturn, the threshold would sometimes be determined by the state’s average unemployment rate over the prior 3 years. This component of the formula would offer a modest amount of additional aid to states that started out with unemployment rates particularly far below their historical norms. However, this additional assistance would phase out relatively quickly as the 3-year-average “caught up” to the present. Even now, including the 3-year-average component in the threshold formula reduces the (unweighted) mean state threshold by less than 0.3 percentage points.

You must be logged in to post a comment.