Health insurance is a highly regulated product, overseen by state and federal authorities. However, today’s market features a wide variety of loopholes that allow unregulated products to proliferate, which may lead many consumers to purchase inadequate coverage without realizing it and increase premiums for people who rely on traditional comprehensive coverage. One pernicious example is fixed indemnity coverage, a benefit that is exempt from regulation but often masquerades as a traditional health insurance product. Fixed indemnity products are offered in problematic and nontransparent ways in the individual market for health insurance and by employers offering coverage to their workers. However, Congress, federal regulators, and states all have options to tighten regulation of these products and prevent them from undermining health insurance consumers and markets.

What Is Fixed Indemnity Coverage?

Traditional health insurance charges its enrollees a monthly premium, in exchange for paying for some or all of the health care services an individual receives. Fixed indemnity (also called hospital indemnity) coverage is designed differently, with payments made on a “per time period” basis. Rather than paying health care providers for providing specific services, fixed indemnity coverage provides a payment for each day (or month, or other time period) an individual is hospitalized or experiencing illness.

Historically, this benefit was understood as a form of income replacement. That is, these policies were intended not to pay for medical care directly but instead to provide an alternative source income at a time when ability to work might be limited just as expenses were rising. Because it was thought to serve a different purpose than traditional health insurance, fixed indemnity coverage has, since the mid-1990s, been defined as an “excepted benefit” that is not subject to most federal health insurance regulations. Notably, the health insurance standards of the Affordable Care Act (ACA) do not apply to excepted benefits, so fixed indemnity coverage may discriminate based on pre-existing conditions, decline to cover the ACA’s essential health benefits, and need not cap enrollees’ annual out-of-pocket spending.

What Does This Market Look Like Today?

In its historic format – paying a fixed benefit per day of illness, like $100 per day a patient is hospitalized – fixed indemnity coverage does not function as a substitute for health insurance. It is insuring not against the costs of health care services, specifically, but against the risk of disrupted income at a time of increased expenses. Households may of course reasonably choose to buy this product, especially as a complement to traditional health insurance.

However, some modern benefit designs look very different. We are not aware of systematic data on fixed indemnity coverage in the individual or group market, but plan materials available to prospective consumers provide a glimpse into the nature of the benefits. Rather than paying a fixed amount per day of illness or hospitalization, generally, many existing fixed indemnity plans vary payment widely based on the specific health care services enrollees receive. That is, they pay $100 per visit to the pediatrician (or, in some plans, “per day” an enrollee visits the pediatrician), $30 per prescription for amoxicillin, and $1,000 per tonsillectomy. Plans may also have a more complex benefit design that mimics traditional insurance, requiring enrollees to hit a deductible before payout begins. Moreover, some modern indemnity products pay these amounts directly to health care providers – not to the enrollee – and have a network of providers with whom they have negotiated discounted rates for enrollees of the plan. In other words, these fixed indemnity plans can begin with a design that looks very much like a traditional health plan, append the phrase “per day” or “per service” to their reimbursement schedule, and render themselves exempt from regulation.

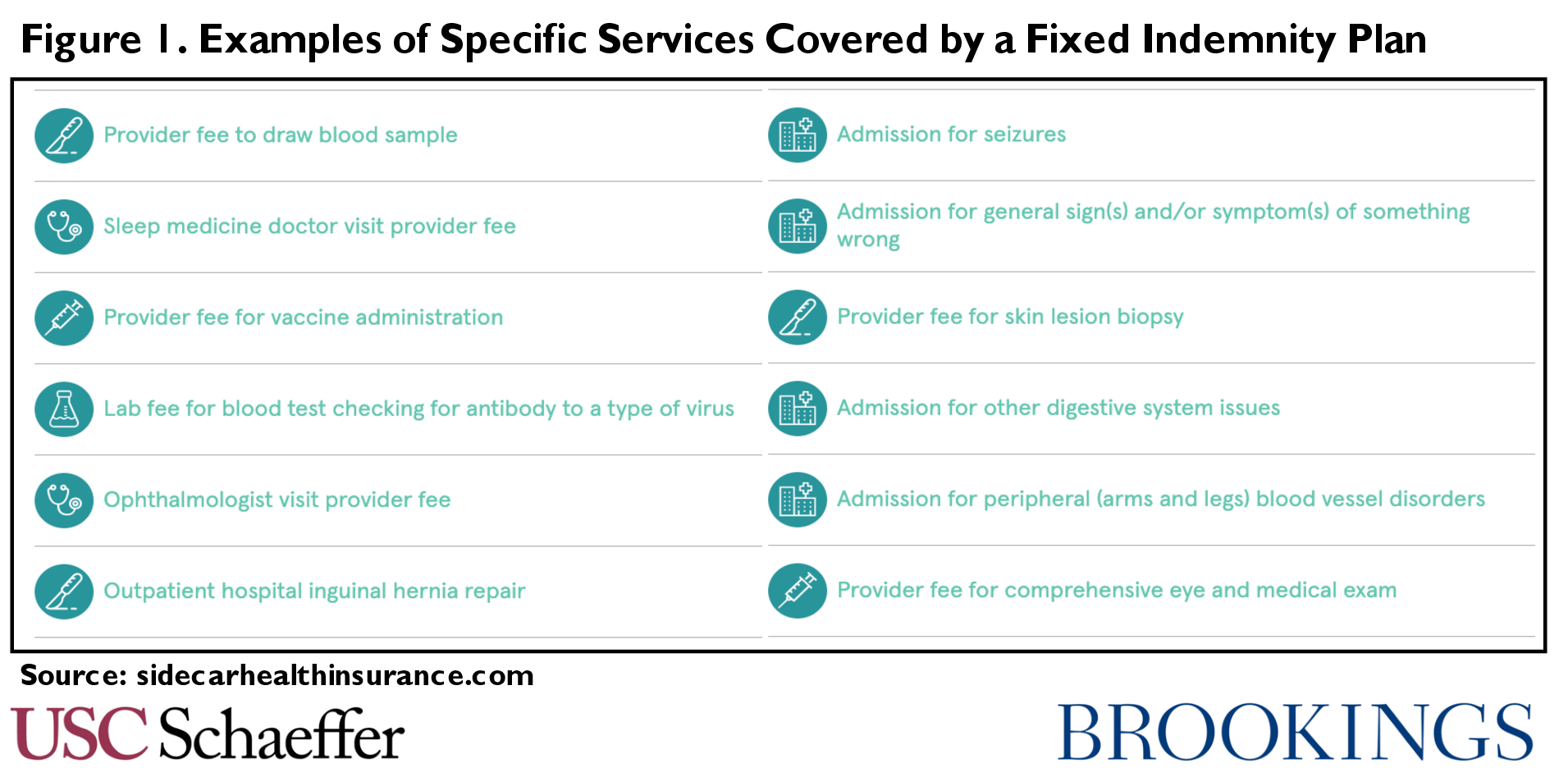

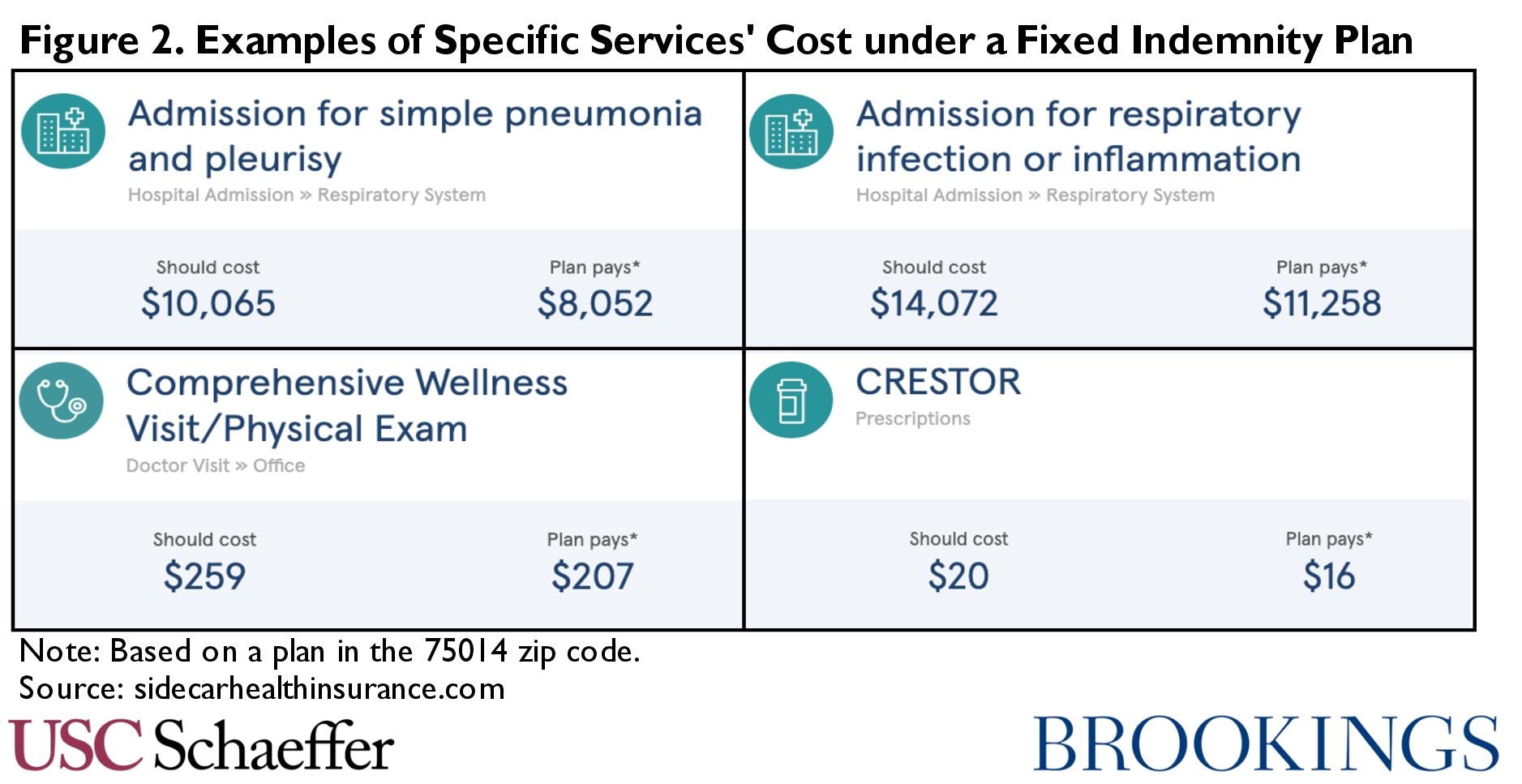

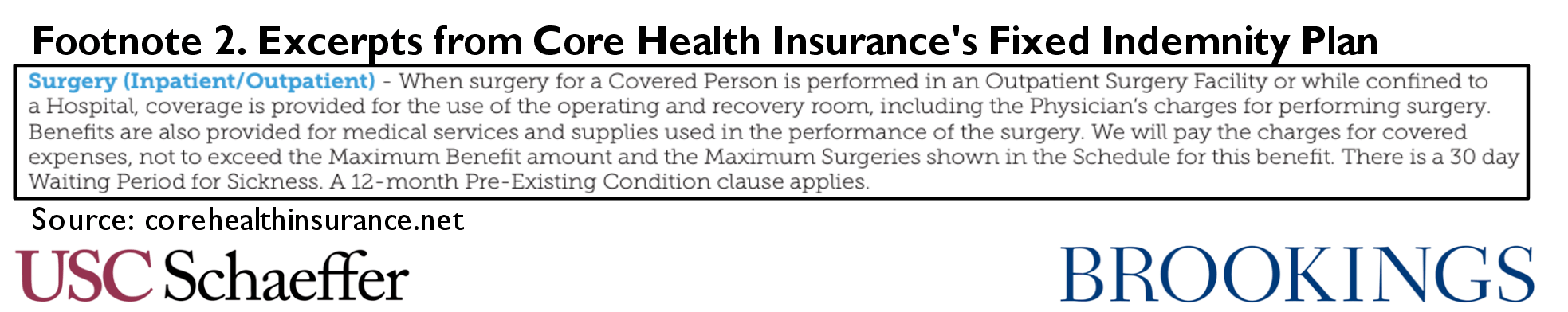

One striking example is an app–based product available for sale in eleven states[1], which has 170,000 different reimbursement amounts for specific services. To pick just a few examples, the plan reimburses $3 for a blood draw, $153 to see an OBGYN, $1,119 for a 30 day course of the antibiotic Xifaxan, $7,198 if admitted to the hospital for a skin infection, and $10,903 if admitted to the hospital for a collapsed lung. Figures 1 and 2 show excerpts from the plan website, including a handful of the thousands of different payment amounts in this “fixed” indemnity product. While the plan is not transparent about how these payment amounts are derived, the benefit arrangements for hospital admissions and outpatient services appear to largely use Medicare’s Diagnosis Related Group (DRG) and Healthcare Common Procedure Coding System (HCPCS) service definitions, respectively, with a separate payment amount for each DRG and HCPCS code – the same basic structure as many traditional health insurance products.

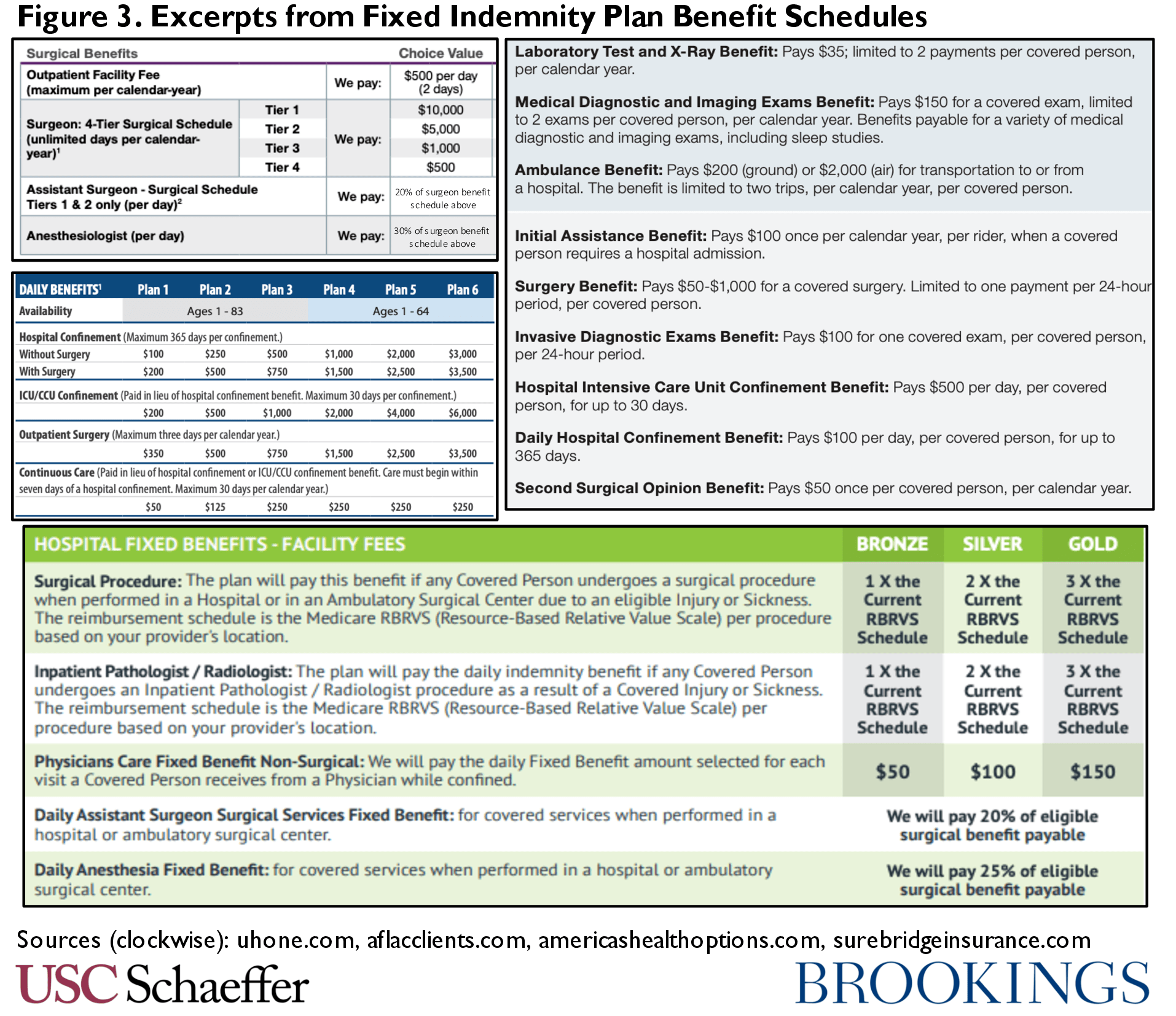

While this product is the most extreme example we encountered in our research, all fixed indemnity products we encountered vary payment amounts with the intensity of the medical care received to at least some degree. Payment for outpatient care is often highly variable, while payment for hospital services often varies along a smaller number of dimensions. For example, one plan pays an amount for hospitalization that varies only with whether or not the admission is for illness or injury, but outpatient services are paid as a multiple of the Medicare allowed amount for the actual care received. A large national carrier (that has a major online presence in many states) offers a multi-faceted reimbursement formula for surgeries: benefits are paid based on a four-tier schedule reflecting the complexity of the surgery plus separate amounts for anesthesiologists, assistant surgeons, and the outpatient facility fee. In this product, payment for a hospital admission does not vary based on the specific diagnosis, but does reflect characteristics of the care needed, such as whether it is in an ICU, what providers treat the patient on a given day, and whether the hospitalization is for illness or injury. Another carrier offers a fixed payment per day of “hospital confinement” but varying payments for short-stays in the hospital, emergency room visits, nursery stays for a newborn, “intensive” hospital diagnostic services, and the like. Many plans also allow consumers to select the level of reimbursement they would like to purchase ranging from, e.g., $100 to $3,000 per day of hospitalization – where the former reflects a product that might logically serve as income replacement while the latter is a benefit that is more likely to be conceived as payment for medical expenses. Figure 3 displays excerpts from some of these plan materials.

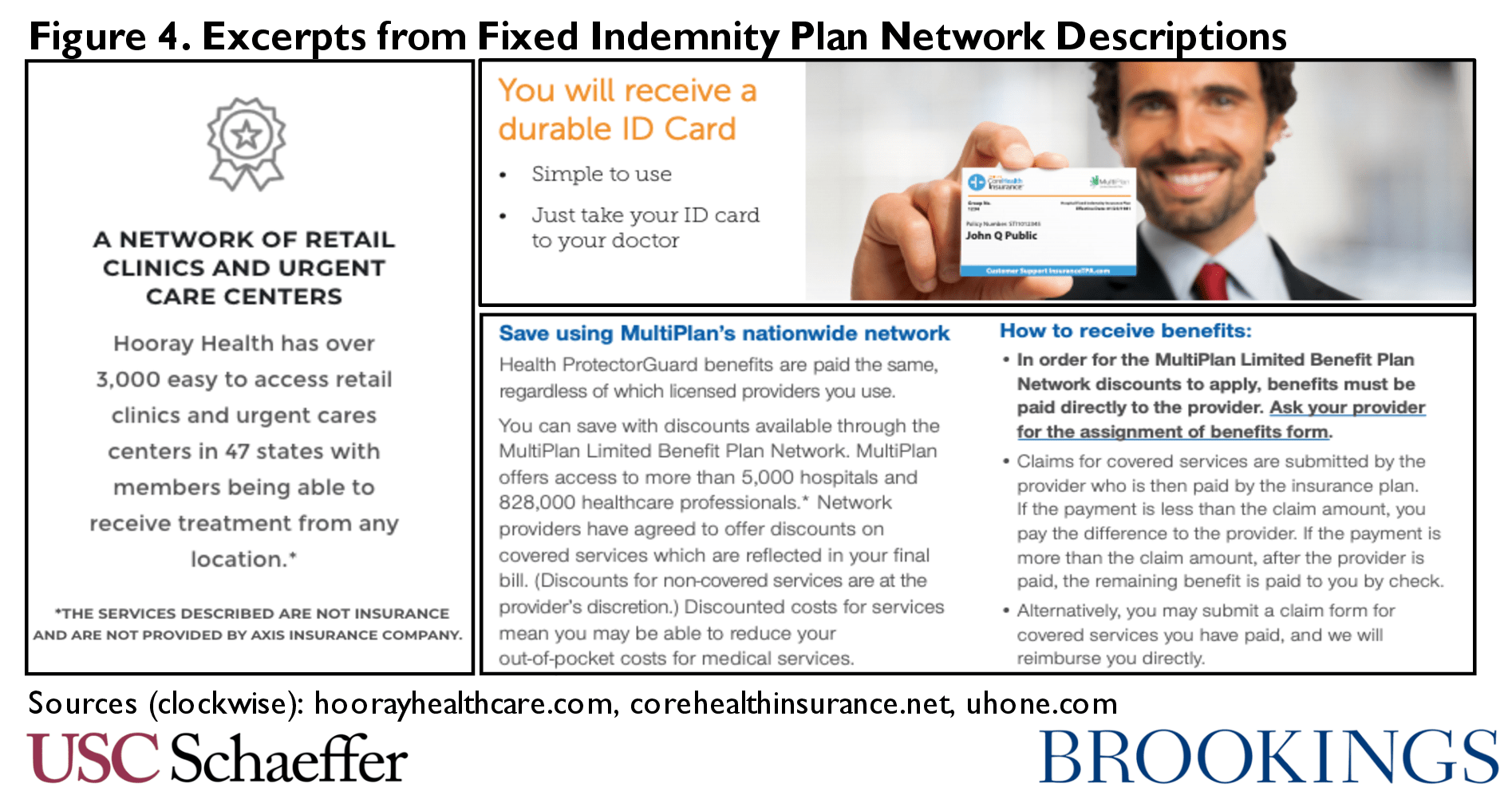

Carriers’ network arrangements can also be sophisticated and reminiscent of traditional insurance, as shown in Figure 4. One fixed indemnity plan boasts of its large network with nearly 5,000 hospitals and a million physicians nationwide. Enrollees in the plan receive a discount below the providers’ usual rate for self-pay patients, though the magnitude of the discount is unclear. The fixed indemnity carrier will pay its scheduled amount to the provider, and the provider will bill patients for any remaining balance. (In this plan, if the payment amount is larger than the provider’s bill, the additional amount would be paid directly to the consumer.) Some carriers offer ID cards, intended to be used like a traditional health insurance card where the provider bills the plan through standard electronic transactions. Another carrier offers a payment card that is linked to the enrollee’s plan and is used by the enrollee at the point of care for participating providers. When the payment card is used, the plan pays its share, and the enrollee’s credit or debit card on file with the plan is automatically debited for remaining amounts. These sorts of arrangements illustrate that the fixed indemnity product is clearly designed as the primary source of payment for medical care. A product intended to provide general income replacement or to help families pay a variety of expenses would have little need for a complex mechanism to route payments directly to providers; a product marketed to consumers as a substitute for traditional health insurance, on the other hand, has a clear reason to rely on these arrangements.

What Are the Problems With This Type of Benefit?

Fixed indemnity benefits that masquerade as traditional health insurance pose risks for consumers in the individual and employer markets.

Product Limitations

First, consumers may purchase this product as a substitute for health insurance despite its serious limitations compared to comprehensive health insurance. Consumers are often seeking a product that transfers catastrophic financial risk to the health plan, but fixed indemnity products – almost by definition – do not do this. They set a payment amount associated with a specific service or kind of service is received, and consumers are responsible for any difference between this set payment amount and the actual cost of care.[2] In some fixed indemnity products, the plan will leave consumers exposed to significant additional costs in almost all cases: plans that pay $500 per day of hospitalization or $700 per surgery will leave most patients exposed to very large costs. But even the more complex products with widely variable (and generally higher) payment amounts can also expose consumers to high costs because of the variation in provider charges for services. These problems may be especially acute for non-shoppable and/or urgent health care needs, when consumers’ opportunities to investigate lower-priced alternatives may be limited.

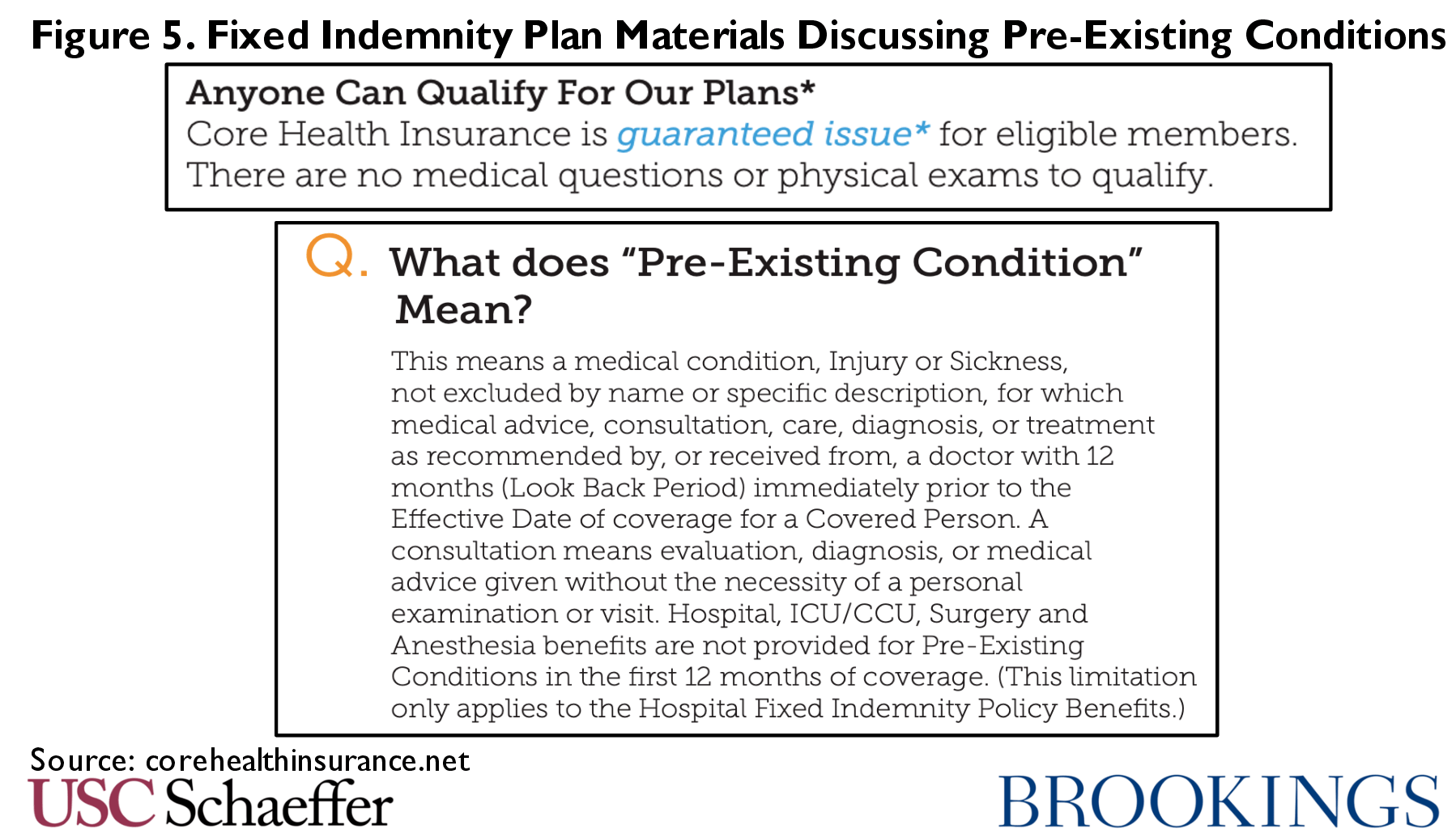

Beyond the limits inherent in the benefit design, some of these products include very low annual or lifetime benefit maximums layered on top of the per service benefit limits. For example, one carrier offers a plan with $10,000 annual limit. These plans also exclude coverage for health care needs based on pre-existing conditions. Some screen for health conditions at enrollment. For example, a hypothetical 37–year old woman is denied the opportunity to enroll online if she reports taking generic medications to treat migraines – even if reporting no other health care needs. Other plans (particularly those offered through associations as described below) boast of allowing anyone to enroll but refuse to pay claims associated with pre-existing needs of their members for some period of time. Data are not available, but it is likely that carriers engage in extensive post-claims underwriting to deny claims, as is seen in other underwritten health insurance markets.

Some consumers, particularly healthy people, may deliberately elect this benefit, preferring the lower premium and lower or absent deductible to the comprehensive coverage available in regulated plans. Others, though, purchase fixed indemnity products thinking them to be traditional, regulated health insurance. As described above, fixed indemnity products can very much resemble traditional health plans, especially for consumers who are not familiar with insurance terminology. Some plans (generally those with designs less reminiscent of traditional health insurance) describe their benefit as supplemental or highlight that it can be used to pay a variety of non-medical care expenses. But for plans with the more advanced designs described above, marketing tends to emphasize that they are a “simple” form of health benefit, and to use words like “health insurance” or “health plan” throughout their materials, as shown in Figure 6. All plans also include a disclaimer mandated by federal law in their marketing materials, though not always in a prominent location.

Indeed, brokers marketing these products have been trained to use scripts that are designed to obscure the nature of the plan or make consumers believe the product is regulated under the ACA. Consumers who accidentally purchase a fixed indemnity plan may find themselves surprised by large bills if they have a serious medical event, such as a woman who faced $20,000 in medical bills after a partial amputation of her foot or a consumer who was shocked her plan paid only $2,000 after a major injury. Moreover, the use of post-claims underwriting makes it very difficult for consumers to know the value of the coverage they are purchasing, because they cannot know what future health needs might ultimately be called a pre-existing condition.

Undermining Risk Pooling

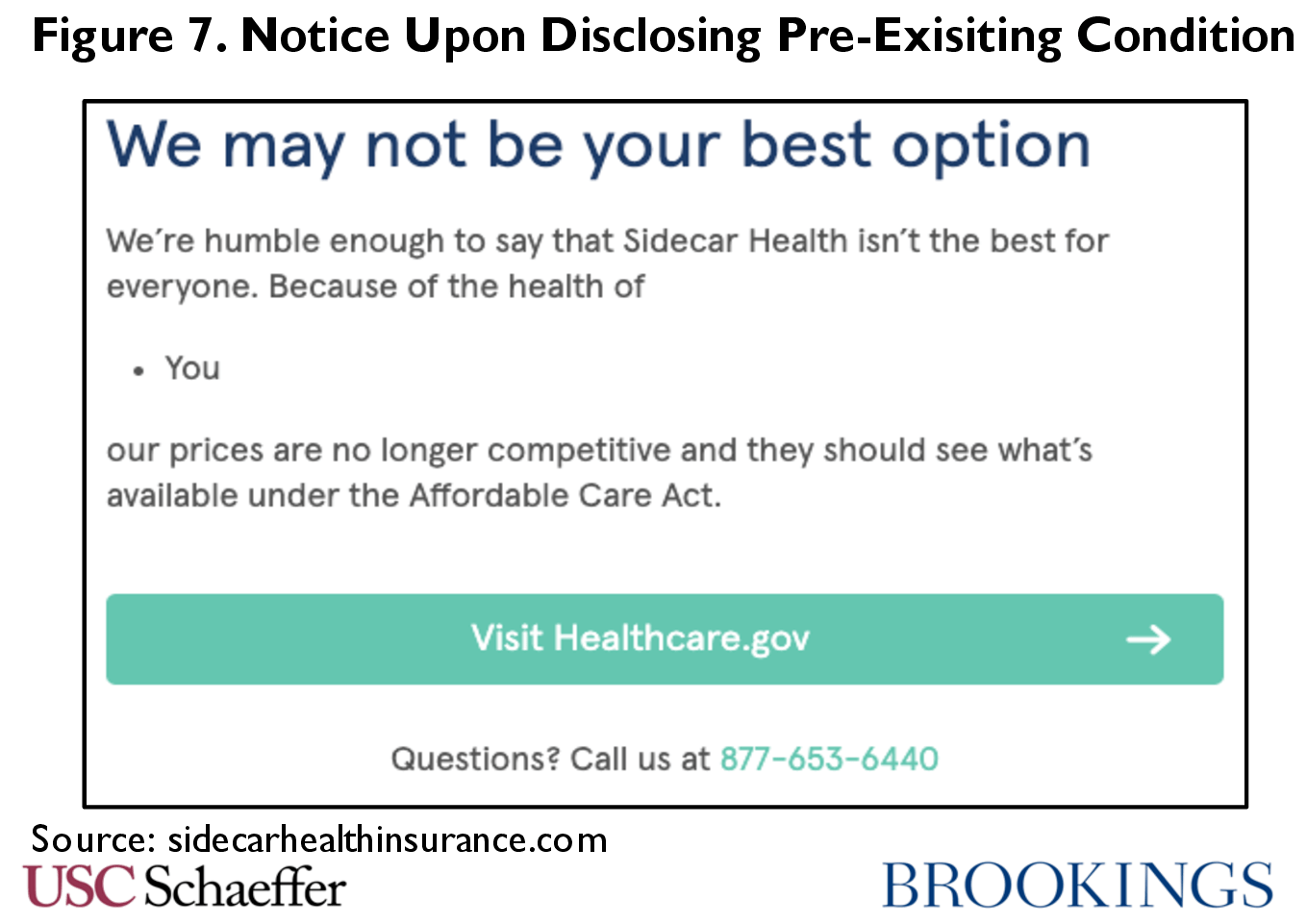

In addition, even when consumers fully understand the benefit they are purchasing, fixed indemnity products (like other forms of underwritten health insurance) cherry-pick healthy enrollees out of the regulated market. Thus, while they may be a lower-premium, albeit limited, coverage option for consumers who can pass underwriting, they lead to higher premiums for those who enroll in comprehensive and regulated coverage. This also increases costs for the federal government, which subsidizes premiums for about 70% of individual market enrollees. All forms of unregulated coverage have this impact, though some fixed indemnity carriers appear to deliberately encourage relatively sicker consumers to seek their benefits from the Marketplace, as shown in Figure 7.

Employer Misuse

Finally, unlike short-term health plans (another familiar form of junk insurance) that are available only to individual consumers, fixed indemnity plans have also been used by employers to avoid regulation. To be sure, some employers offer fixed indemnity plans that are intended as a supplement to traditional health insurance – an optional income replacement product that employees may choose to carry alongside their health coverage. However, we find widespread anecdotal evidence of employers misusing fixed indemnity products and offering them to their employees as the primary employee health benefit, in ways inconsistent with the justification for exempting these plans from regulation.

Fixed indemnity products may appear to be an attractive low-cost option for employers because they need not comply with various ACA requirements, most prominently the prohibition on annual and lifetime dollar limits on benefits. They allow an employer to offer some coverage for a type of medical care, like hospitalization, without becoming responsible for the full magnitude of what that type of care may cost. (In the individual market, another significant driver of low cost is that the plans are underwritten and the healthy do not pool risk with the sick, a feature that is less applicable in the employer context.) Moreover, because employees are unlikely to be aware of the likely costs of these services, they have limited ability to accurately evaluate, for example, $300 per day in hospital benefits.

One important downside of fixed indemnity plan from an employer’s perspective is that it does not qualify as an offer of coverage under the ACA’s employer mandate. For this reason, it is generally not in the employer’s interest to offer only a fixed indemnity plan. However, some employers have arrived at a strategy that allows them to minimize both their exposure to employer mandate penalties and the scope of the ACA’s consumer protections.

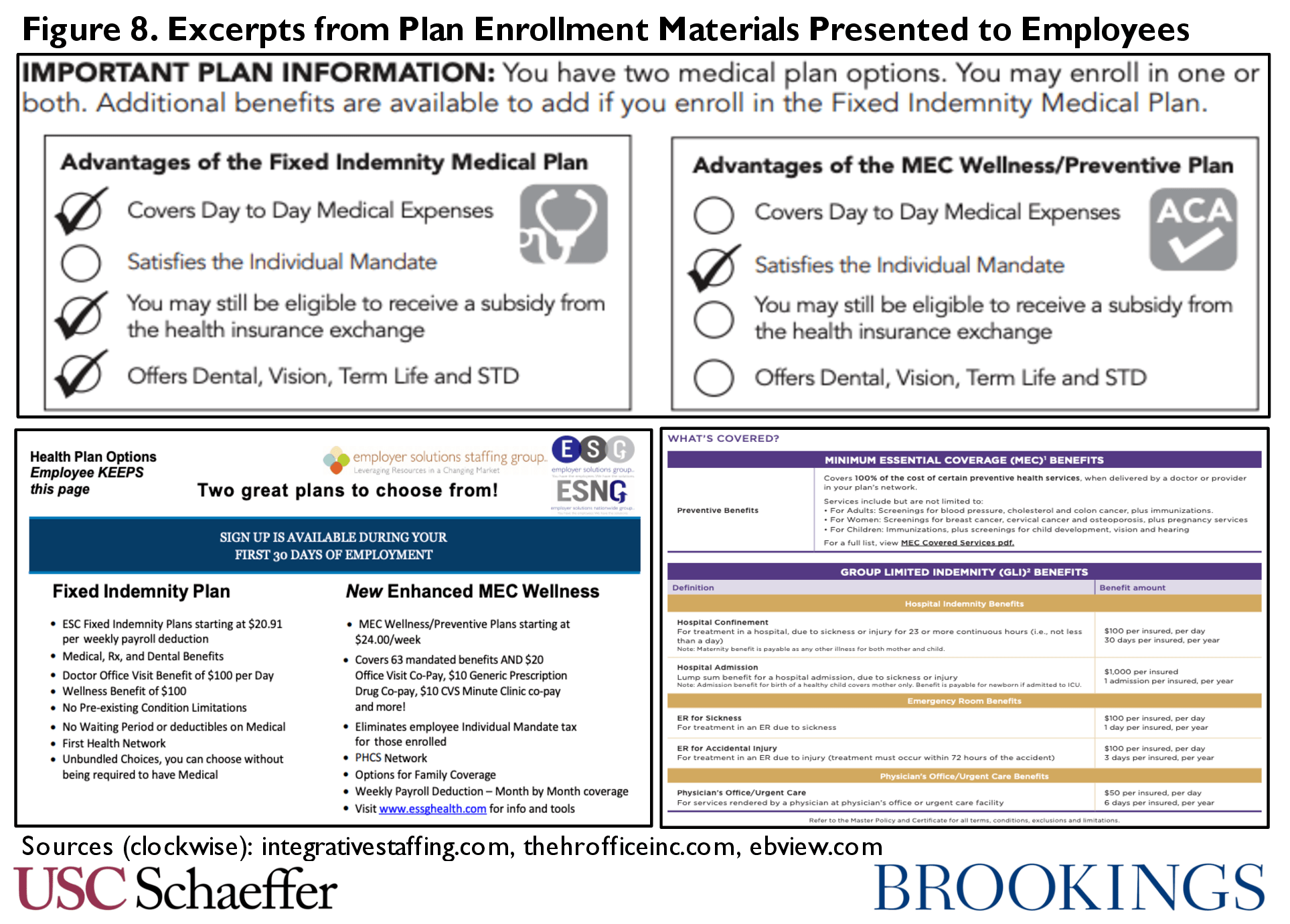

Specifically, they offer two health benefits – a regulated plan that covers a very limited set of services (like primary and preventive care) and a fixed indemnity plan that covers all other benefits. One common design is to offer only the ACA’s required preventive services in the regulated plan, and offer all other benefits through the fixed indemnity product. A cursory search reveals numerous vendors and consultants that market this arrangement to employers (usually using the term “MEC plan” to describe the very limited regulated plan). Excerpts from plan enrollment materials presented to employees appear in Figure 8.

As the figure shows, plan enrollment materials are technically accurate, but generate the impression that the fixed indemnity plan is a form of employer coverage similar to the regulated plan. As shown above, it is described as coverage for “day to day medical expenses” or “medical, Rx, and dental benefits.” This seems likely to generate confusion among enrollees; a worker offered one of the plans shown in Figure 8 posted on Reddit with the query “I feel like my employer is deliberately giving me misleading information about my health insurance and I need your help.” Another employee offered a plan from a major national carrier could not figure out how his ulcer medications would be covered, while still another providing advice to a family member about enrollment was convinced the plan should have an out-of-pocket maximum. Given this confusion, people may enroll and only uncover the limitations when they have a medical event. For example, a man in Texas was surprised by $67,000 in hospital bills after a heart attack, unaware his employer plan offered most of its benefits through a fixed indemnity product that would pay only $400 for the episode of care.[3]

What Can Policymakers Do?

Congress, federal agencies, and states can all take steps to address misuse of the fixed indemnity market and limit the exemption from regulation to plans that truly serve a different purpose from traditional health insurance.

Congress

The simplest solution is for Congress to change the law so that a fixed indemnity plan only qualifies as an excepted benefit if two conditions are met: (1) the benefit design must be truly “fixed” and (2) enrollees must maintain other coverage. To ensure a fixed design, policymakers can clarify that fixed indemnity plans cannot offer benefits that vary with an individual course of treatment, while still allowing plans to vary payment based on major distinctions like the setting of the care (e.g. whether a patient is hospitalized). Congress may also consider adding anti-abuse language that establishes clear authority for regulators to prevent attempts to evade these prohibitions.

For example, Congress could add the underlined text below to the language appearing at § 2721(c) of the Public Health Service Act (and make parallel modifications elsewhere in federal law) to achieve these objectives:

(3)Benefits not subject to requirements if offered as independent, noncoordinated benefits

[….]

(B)Hospital indemnity or other fixed indemnity insurance that meets all of the following requirements:

(i) The coverage is provided only to individuals enrolled in other coverage that includes the essential health benefit package as defined in section 2707(a) of this title,

(ii) The coverage does not vary payment with the services received, the severity of the illness, injury, or diagnosis, or other characteristics particular to a course of treatment; and

(iii) The coverage does not duplicate, supplant, or mimic the benefits otherwise provided under this title.

This step may be particularly important if Congress also takes action to restrict or eliminate short-term plans. Given the ongoing signs of abuse of the fixed indemnity benefit form and the fact that major players in the short-term plans market are already offering complex fixed indemnity products, there is a real risk that closing down the short term plans loophole without also addressing fixed indemnity coverage would simply lead the underwritten market to shift to fixed indemnity plans. Therefore, if Congress wants to eliminate underwritten alternatives to individual insurance, it would be wise to address these products together. Indeed, one of us has argued elsewhere that a comprehensive fix should also tackle a few other forms of unregulated insurance along with short-term and fixed indemnity plans.

Federal Agencies

In the absence of new legislation, federal agencies can also take steps to limit problematic fixed indemnity polices. In fact, in 2014 the federal government attempted to adopt new standards for fixed indemnity plans, but critical parts of those regulations were blocked by a federal court. Specifically, the 2014 regulations attempted to impose a requirement that fixed indemnity enrollees in the individual market carry another form of coverage, but the court concluded that the statute did not allow agencies to define “additional criteria” for fixed indemnity plans. Therefore, if policymakers wish to pursue that approach, it must be implemented legislatively. But nothing in the court’s opinion affects the federal government’s authority to define a fixed indemnity plan through regulation. Congress has regulated most forms of health insurance but provided that fixed indemnity plans are exempt; therefore, there must be specific features that distinguish excepted from regulated coverage. That is, agencies retain authority to regulate the degree to which fixed indemnity coverage must actually be “fixed.”

Current regulations governing fixed indemnity coverage in the group market specify that fixed indemnity coverage “must pay a fixed dollar amount per day (or per other period) of hospitalization or illness (for example, $100/day) regardless of the amount of expenses incurred.” Some of today’s carriers thus infer that any payment schedule that appends the phrase “per day” to a benefit amount and does not vary with actual costs is permissible. Even more problematically, regulations governing the individual market allow payments to vary per time period “and/or per service ([for example] $50/visit).” This per service language was added at the time of the 2014 rule change described above that required enrollees to carry other coverage. The agencies concluded that because carriers knew enrollees had other coverage, the benefit would naturally be designed to avoid duplicating traditional coverage and there was no need to impose restrictions on design that ensured this outcome. However, when the federal court struck down the requirement to have other coverage, the “per service” language remained in place.

The statute does not compel these expansive definitions. Federal agencies can pursue a definition in both the group and individual market specifying that indemnity coverage must be “fixed” in meaningful ways that distinguish it from traditional coverage. For example, the agencies could adopt the approach articulated above, specifying that the coverage “must pay a fixed dollar amount per day (or per other period) of hospitalization or illness (for example, $100/day) regardless of the amount of expenses incurred, the services received, the severity of the illness, injury, or diagnosis, or other characteristics particular to a course of treatment.” It should also be coupled with updates to the disclosure requirements that educate consumers on the specific role of fixed indemnity coverage.

This would require most fixed indemnity carries to make some changes in their benefit designs, and would likely eliminate the segment of the market that attempts to compete directly with comprehensive coverage. This would certainly generate opposition from plans and could be expected to lead to litigation. However, the agencies have a strong argument that a plan paying $8,958 dollars when an enrollee is hospitalized for a lung artery blockage and $8,870 when hospitalized for a peripheral blood vessel disorder cannot claim that the statute requires agencies to categorize its benefit as “fixed.”

Federal regulators also have options to better oversee the way in which employers offer fixed indemnity coverage, even without amending their regulations. The statute specifies that fixed indemnity coverage in the group market is a “noncoordinated” excepted benefit, a term not defined in statute. Existing regulations therefore require that “there is no coordination between the provision of the benefits and an exclusion of benefits under any group health plan maintained by the same plan sponsor.” Yet recall in Figure 8 that we saw employers presenting their fixed indemnity and regulated coverage as a package consisting of complementary parts. Employers appear to interpret the prohibition on “coordination… with an exclusion” to forbid only contractual coordination of benefits prohibitions, as that term is used in insurance law. But a more natural use of the phrase would suggest that the fixed indemnity plan in these examples is, in fact, very carefully coordinated with the benefits excluded from the regulated plan. The agencies could explain as much in guidance, stating that the sorts of pairing employers are offering today represents unlawful coordination with an exclusion within the meaning of the regulations.

States

States may also pursue variants of these potential federal steps. Just as 25 states have acted to address the proliferation of short-term plans in their markets, states can also limit the reach of fixed indemnity plans. Indeed, anecdotally, we see evidence of fixed indemnity plans designed to compete with comprehensive individual market coverage in many states that have taken aggressive action to prevent short term plans.[4] Therefore:

- States may establish a requirement in state statute, regulation, or bulletin that fixed indemnity plans may only be sold to people with other coverage. The court decision striking down this approach in federal regulation does not affect states: states have plenary authority to regulate insurance products, not rooted in the text of the Public Health Service Act, and so may impose “additional criteria” under state law as long as they are not weaker than federal standards.

- Similarly, states can require that fixed indemnity benefits do not vary with “the services received, the severity of the illness, injury, or diagnosis, or other characteristics particular to a course of treatment,” or similar standards that limit the amount of variation within the plan. State regulators may also have authority to simply refuse to approve indemnity products with benefit designs they deem insufficiently “fixed,” so they should carefully review products seeking approval.

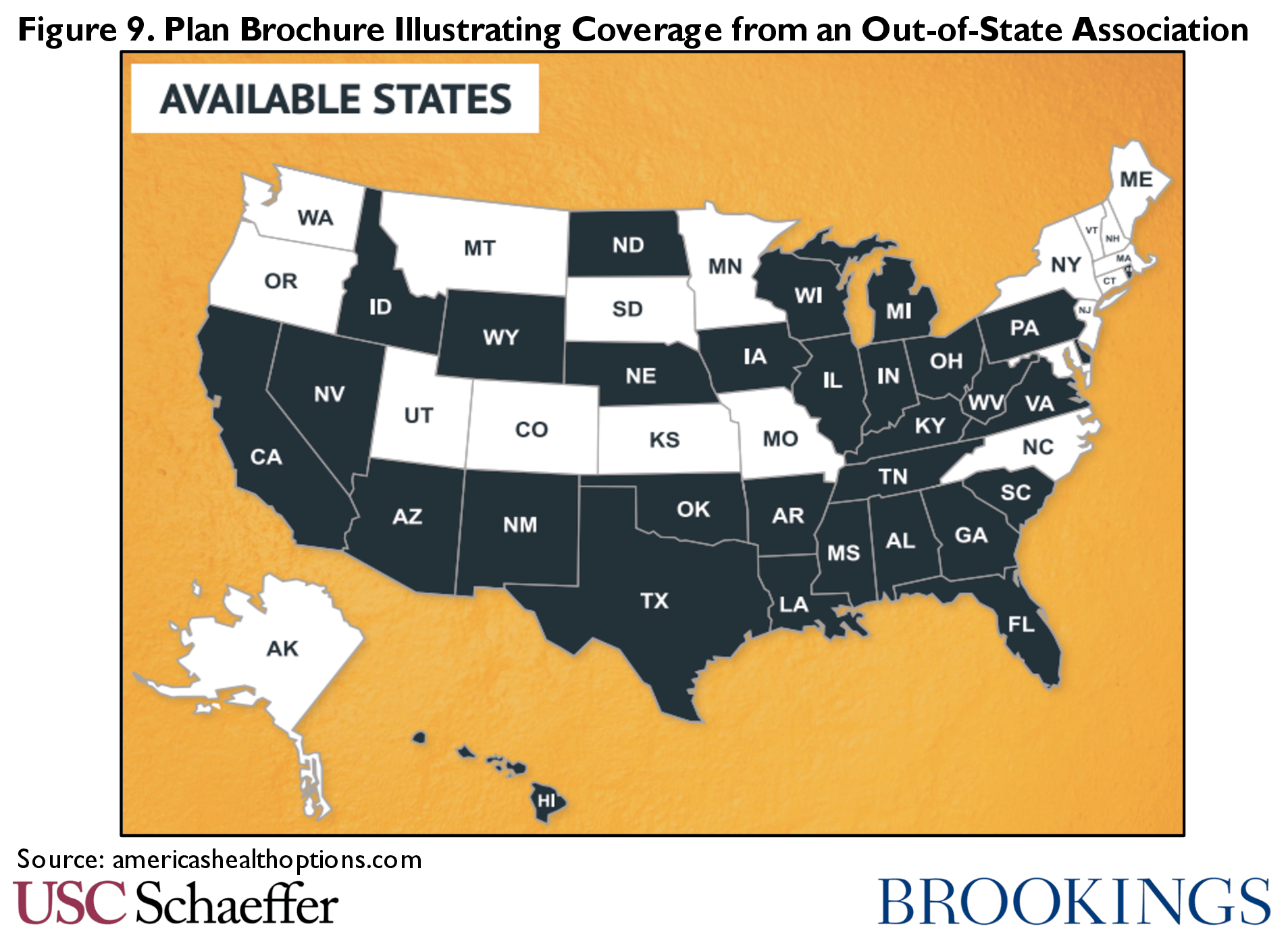

That said, substantive standards in state law are not all that is necessary. Some fixed indemnity plans are operated through “out-of-state associations.” The association forms in a single state and is licensed to offer an individual fixed indemnity product in that state – but sells the product to residents of many other states.[5] In that case, the state of residence has not examined or approved the product and it does not necessarily comply with the substantive or solvency protections of state law. (This same conduct appears to be very common in the short-term plans market as well.) Federal law does not authorize out-of-state associations to operate in this way; states have authority to regulate insurance sold to their residents. Some states have clearly asserted jurisdiction over these plans and barred them from sale; states should uniformly take this step.

States also have some ability to oversee employers’ conduct in offering fixed indemnity plans. The Employee Retirement Income Security Act (ERISA) and its implementing regulations do not authorize employers to offer “self-insured” fixed indemnity coverage; fixed indemnity plans are only an excepted benefit to the extent that they are offered under a “separate contract of insurance.” Therefore, employer fixed indemnity benefits are offered as insurance in a state and are subject to state oversight. Further, the prohibition on “coordination with an exclusion” in another plan is imposed on the (insured) fixed indemnity product – not just the employer – so the state may enforce it directly. Thus, states can issue guidance that limits complementary indemnity and MEC plans.

Researchers

Finally, we note that much more information is needed about the fixed indemnity market. Ongoing investigation by Congressional leaders, states and insurance commissioners, and a variety of journalists and independent researchers is beginning to provide a clear picture of short-term limited-duration insurance. We have a far less comprehensive and data-informed view of the fixed indemnity market. While the anecdotal evidence presented here and elsewhere is a start, additional research can fill important gaps.

[1] Those states are: Alabama, Arkansas, Florida, Georgia, Indiana, Kentucky, North Carolina, Oklahoma, South Carolina, Tennessee and Texas.

[2] Historically, and in many modern plans, this risk is at least two sided, with the consumer receiving the full amount even if their medical services cost less than the designated payment amount. But even that assumption appears to be eroding. We could find at least one example of a plan that appears to pay at least some parts of its benefit only up to the amount of provider chargers, and does not pay excess amounts to enrollees, as shown below.

[3] The worker was paying $130 per month for the benefit which appeared to cover him and his wife. A married couple in the same region with an income $47,000 or less would receive subsidies that allowed them to pay less than $130 per month for Marketplace coverage.

[4] For example Delaware, Oregon, and Maryland all restrict short-term plans to 3 months or less, but a popular fixed indemnity product from a major carrier designed to resemble major medical is available for sale; the product is also available in a number of states that otherwise restrict short term plans including Colorado, Illinois, Louisiana, Maine, Michigan, Minnesota, Missouri, Nevada, and Wyoming.

[5] These associations are different from “Association Health Plans” under federal regulations.

You must be logged in to post a comment.