What’s the latest in health policy research? The Essential Scan, produced by the Schaeffer Initiative for Innovation in Health Policy, aims to help keep you informed on the latest research and what it means for policymakers. To receive the Essential Scan in your inbox, sign up here.

Editor’s Note: The Essential Scan is produced by the Schaeffer Initiative for Innovation in Health Policy, a collaboration between the Center for Health Policy at the Brookings Institution and the USC Schaeffer Center for Health Policy & Economics.

A comprehensive policy approach to health care provider competition

Martin Gaynor, Farzad Mostashari, and Paul B. Ginsburg outline a comprehensive approach to health care provider competition policy involving antitrust enforcement agencies, state governments, and private stakeholders that maintains current competition, prevents anticompetitive practices, and encourages new entry. To maintain current competitiveness of provider markets, the authors suggest an expansion of site-natural payments, reductions in administrative and regulatory requirements, and greater support to independent practices in adopting and finding success under alternative payment models. To prevent anticompetitive practices by dominant providers, the authors suggest continued antitrust review with increased scrutiny of health system acquisition of provider practices and of anticompetitive contract provisions with insurers. To promote new entry into provider markets, the authors suggest that certificate of need and “any willing provider” regulations be either repealed or require an assessment of their impact on provider competition, as well as increased licensure reciprocity and an encouraging regulatory environment for telehealth innovation. While “many health care markets are not competitive enough to serve patients well,” the authors assert that these policies provide actionable steps to promote the meaningful competition required to “effectively serve all Americans.” Full JAMA Viewpoint (a white paper that also covers insurer competition will be published next month by the Brookings Institution).

Benefit mandates found to not reduce employer-sponsored coverage, but slightly decrease wages and full-time status

Yaa Akosa Antwi and Johanna Catherine Maclean find state mandates to include high-cost benefits do not decrease workers’ likelihood of employer-sponsored coverage or weeks worked, but instead reduce wages and labor for an extended period. Since the 1940s, states have regulated private health insurance coverage, including through mandates that cover specific treatments, provider types, and population categories. The authors evaluate the impact of five high-cost coverage mandates (alcohol abuse treatment, illicit drug treatment, mental health treatment, chiropractic services, and continuing coverage) for their impact on employment from 1976-1990. They found each additional high-cost mandate reduced wages for men and women 0.7 and 0.6 percent, respectively, as well as the likelihood of holding a full-time job by 0.3 percentage points for men and 0.4 percentage points for women. These findings highlight the possibility of distortions in wages and labor caused by private health insurance coverage mandates, providing evidence for policymakers to “consider the downstream and perhaps unintended consequences” of such coverage mandates. Full article here.

Part D reduced overall elderly mortality 2.2 percent, cardiovascular elderly mortality 4.4 percent

Jason Huh and Julian Reif estimate that Medicare Part D drug coverage reduced elderly mortality by 2.2 percent annually with an estimated value of $5 billion per year. Cardiovascular disease mortality– the leading cause of elderly deaths at 40 percent– declined by 4.4 percent annually and was the primary driver of overall mortality reductions. In contrast, the authors observed no reductions in cancer mortality– the second leading cause of elderly deaths at 22 percent and for which drug treatments are covered under Part B. Using mortality and prescription drug data from 2001-2008, the authors also find that Part D increased total per capita drug use by 3.08 prescription fills and $244 in expenditures. These findings add a national analysis of the impact of drug benefit coverage on mortality, as well as prescription drug utilization and expenditures. Full article here.

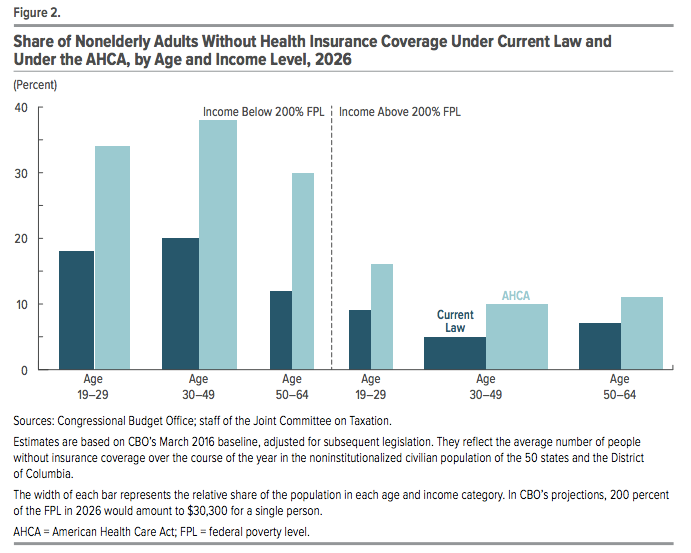

CBO estimates GOP health proposal to leave 24 million more uninsured by 2026

The Congressional Budget Office estimates that the American Health Care Act would increase the number of uninsured Americans by 24 million by 2026. This breaks down to roughly 14 million fewer Medicaid enrollees, 7 million fewer individuals with employee-sponsored insurance, and 3 million fewer non-group market and basic health plan enrollees. Over the next decade, they predict spending to be reduced by $1.2 trillion and revenues reduced by $0.9 trillion, resulting in a $337 billion federal deficit reduction. Premiums are estimated to increase 15-20 percent over current law in 2018 and 2019. By 2026, average premiums are expected to be 10 percent lower compared to under current law due to a younger mix of enrollees and insurers being able to offer plans of lower actuarial value. However, despite average premiums in the market dropping, the CBO predicts most people who currently buy coverage will see their total health care spending increase, especially when adjusted for the share of costs the purchased plan covers. Full CBO report here.

“The figure demonstrates how not using income to determine tax credits and not fully adjusting for the age differences in rates permitted in the market means that the tax credits are poorly targeted to increase health insurance coverage.”

– Paul Ginsburg, PhD, Director of the Schaeffer Initiative

You must be logged in to post a comment.