Fifty million Americans are on a financing plan to pay off medical or dental bills, with one-quarter of those bearing some interest. Increasingly, medical payment products (MPPs) – which include credit cards and loans administered by hospitals, physician practices, or third-party companies – have come under scrutiny by the Consumer Financial Protections Bureau, U.S. Department of Health & Human Services and the Treasury.

The agencies’ concern is that the products may be sidestepping a broad range of patient and consumer protections and inflating medical bills with financing costs – but little research existed on the topic.

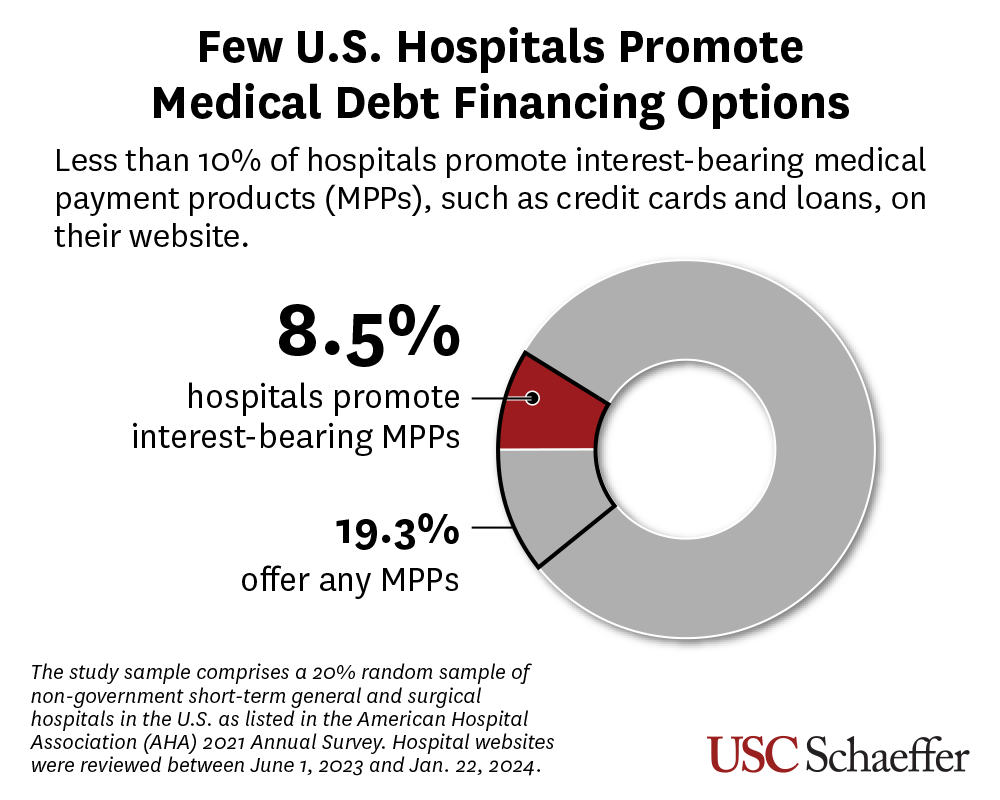

Researchers with the USC Schaeffer Center for Health Policy & Economics conducted a cross-sectional study to find out how often these payment products were being promoted by hospitals. Analyzing a nationally representative sample of hospitals, they found few hospitals promote potentially predatory lending on their websites. Notably, those hospitals that did promote interest-bearing payment products to their patients were more likely to be non-profits and face higher rates of uncompensated care than hospitals that didn’t promote these products.

Their study was published today in JAMA Health Forum.

“As we started our research, we thought we might uncover widespread promotion of interest-bearing credit cards and loans on hospital websites, but that’s not what we found,” said study author Erin Duffy, a research scientist and director of research training at the USC Schaeffer Center. “Fewer than one-in-ten hospitals promoted interest-bearing medical payment products, and those promoting them were disproportionately non-profit hospitals with more uncompensated care. Based on our study, we suggest regulators take a close look at the financial conditions of hospitals promoting medical payment products before enacting regulation.”

Study highlights include the following:

- Of the 670 hospitals in the study sample, 19% offered any MPP.

- 8.5% of hospitals promoted an interest-bearing MPP. Over half of those explicitly described an interest-free promotional period, and the interest rates among the handful that publicly reported them ranged from 5.25% to 29.99%.

- Hospitals offering interest-bearing MPPs were more often non-profit and had higher total unreimbursed and uncompensated care cost as a percent of operating expenses than other hospitals.

- While interest-bearing MPPs were rare, hospital-administered payment plans were common. They were offered by 87% of the hospitals in the sample.

While anecdotal accounts of hospitals partnering with third parties that offer high-interest credit cards have been in the news, researchers say that doesn’t appear to be the typical patient experience with third-party medical financing.

The Schaeffer Center study was already underway when the Consumer Financial Protections Bureau, U.S. Department of Health & Human Services and the Treasury published a request for information about MPPs. While more research may be needed, given the small number of interest-bearing MPPs included in the sample, the researchers say they are hopeful that the results will inform regulators.

“Our findings suggest that if regulators pursue policies limiting hospitals’ ability to promote medical payment products, that may need to be combined with efforts to stabilize hospital finances,” said study coauthor Erin Trish, Co-Director of the USC Schaeffer Center and Associate Professor at the USC Mann School of Pharmacy and Pharmaceutical Sciences. “Hospitals may be relying on these products when they lack the resources to offer longer-term, interest-free financing.”

Additional study authors include Samantha Randall, Nicholas Wong, Josephine Rohrer, and Nina Linh Nguyen. The study was funded by the USC Schaeffer Center.

Sign up for Schaeffer Center news

You must be logged in to post a comment.